The Return of Volatility

RVW equity portfolios generally reverted to values as of January 2021.

The S&P 500 tumbled 20.6% amid expectations of high inflation, a hawkish Federal Reserve and a recession. Other corners of the stock market fared even more poorly. The small-cap benchmark Russell 2000 index is down 24% this year, its worst first half performance since its 1984 inception, as did the tech-heavy Nasdaq Composite which declined by 29.5%. Netflix, Etsy, and Align Technology have the dubious distinction of being the three worst-performing stocks of the first half of 2022. Netflix was down 71%; Etsy fell 67% and Align ended the half down 64%. Crypto also fared badly and we are already seeing the fallout from this mass foray into popular “investments” representing digital creativity – and little else.

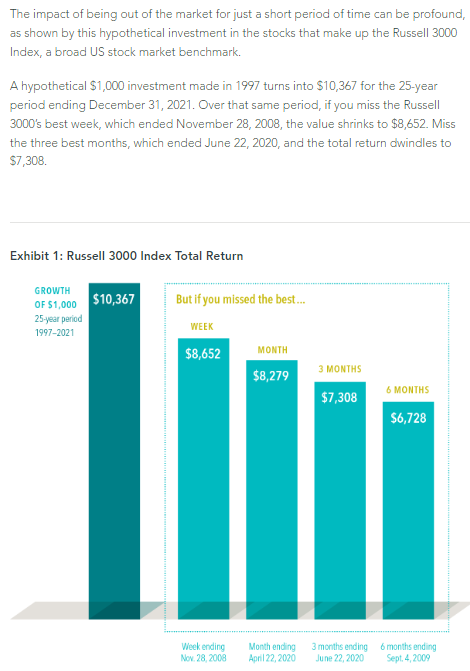

It may seem tempting to pull money out of the market to protect it; but moving to the sidelines could be even riskier than staying invested because timing re-entry into the market is incredibly difficult. Market timers need to get two decisions right: When to get out and when to re-enter – a nearly impossible task. Historically, 78% of the market’s best days occurred during bear markets before it was clear a new bull had begun. Being out of the market will likely mean missing out on its turnaround and turning temporary declines in value into permanent losses.

Historically, heightened bearish investor sentiment tends to be followed by above-average market returns. When the S&P 500 was previously down at least 15% halfway through the year, the index finished higher in the final half every single time, with an average return of nearly 24%.

RVW investors who have been with us for 18 months or more have seen a reset in their equity portfolio values to their approximate values at the beginning of last year. Clients of more recent vintage are seeing declines in value. Because of the dynamic selection process within each ETF you own, be assured that the underlying equity holdings in your portfolio are regularly being reconstituted to ensure that only those companies that comply with the criteria for inclusion are retained and others are sold – hence our description of RVW equity portfolios as “Darwinian” in nature.

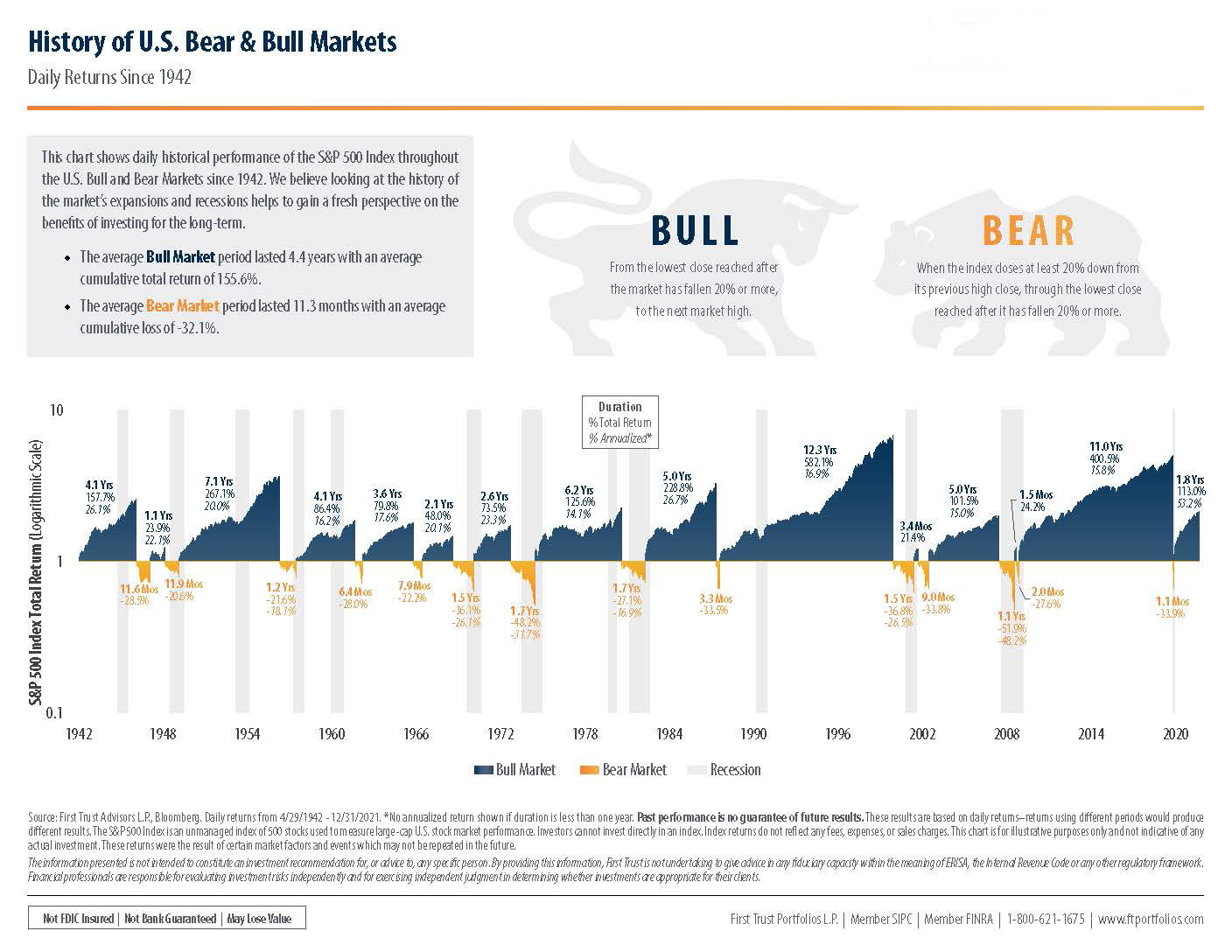

Keep in mind that our portfolios are designed to incorporate the likelihood of a bear market emerging at any stage – in fact on average approximately one out of every 4.5 years includes a severe down market for equities. The key is the understanding that equity markets move up over time – not all the time. Many people mistake volatility for risk. We define risk as the possibility of a permanent loss of principal – and volatility as the periodic overvaluation and under-valuation that the market places on stocks. Selling when the market has declined turns volatility into risk.

In fact, over the past 100 years there has not been a single market downturn that wasn’t overcome in the fullness of time as the equity markets continued their long bumpy ride ever-upward in a north-easterly direction.

Turning lemons into lemonade:

- Tax Loss Harvesting: While market prices are depressed your RVW team has selectively been selling positions that reflect declines from your cost and replacing them with similar substitutes. In this way we maintain the essential design of the portfolio and generate potentially valuable tax losses.

- Roth Conversions: With equity values depressed this may be an ideal time to do a Roth conversion which enables retirement fund asset to grow free of all taxes and with no distribution requirements. Please consult with your tax advisor before taking any action with respect to this.

Alternative Investments: Over the past year we have been selectively including real estate and credit funds into portfolios. These have withstood equity market forces and delivered solid returns. Please contact us if you wish to discuss.

Is A Recession Likely?

The stock market does not reflect the full economy, and equity drawdowns are not reliable recession indicators. Selloffs in 2011, 2015, 2016 and 2018 set the stage for rallies to follow. Volatility has risen this year but is still within its historical norms. Similarly, high

energy prices are an economic headwind, but the economy has grown through intervals of high costs in the past.

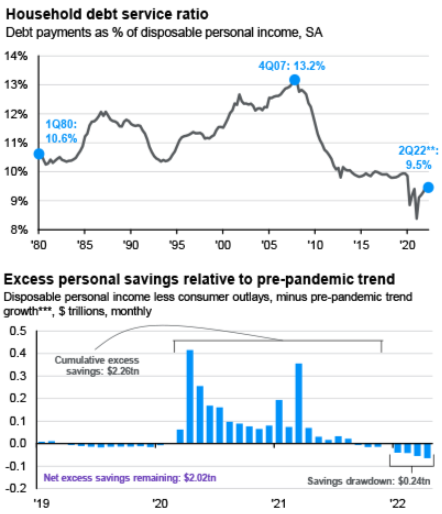

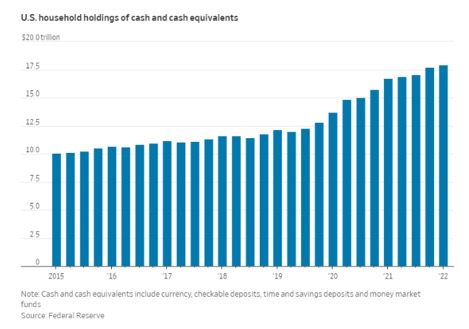

Today’s economy is still marked by high employment, a large number of job openings, continued spending and investment, and well-functioning financial markets. Neither consumers nor corporate America are highly leveraged – and balance sheets of both categories are solid. None of the past signals of recession are present, yet a recession is still possible.

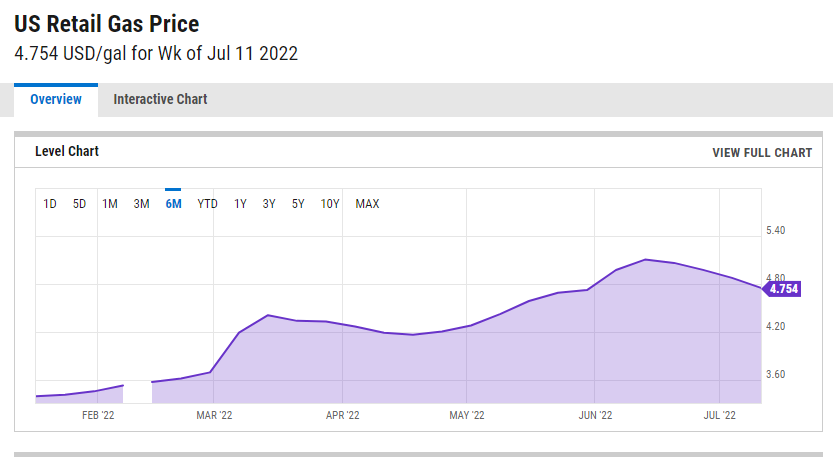

A month ago, the Fed came out with a large 75-basis-point rate hike. Since then, commodity prices have declined, oil prices have plunged 22% and copper has dropped more than 25%. The energy sector–which was up 40% at one point this year–has now fallen nearly 28% from its highs, even more than the technology sector has corrected. The highest average national gasoline price occurred on June 14th (the day the Fed’s meeting started) at $5.01 a gallon according to AAA. The price has since dropped to $4.78. However, we are not yet seeing any signs of inflation abating in the near term because of the multiple factors that created this inflation simultaneously: the Covid-related infusion of money into the system, the supply chain disruptions, the Ukraine war and the Chinese lockdowns.

It should be noted that the Consumer Price Index trends to be a lagging indicator of inflation. What starts off as elevated oil price for example, ends up impacting almost every aspect of the economy due to higher shipping costs and the fact that much of what the economy produces and consumes, has a component of oil or a derivative. In fact, households directly consume oil for transportation and heating, in addition to paying more for goods and services. The decline in oil price should therefore flow through and reduce inflationary forces over time.

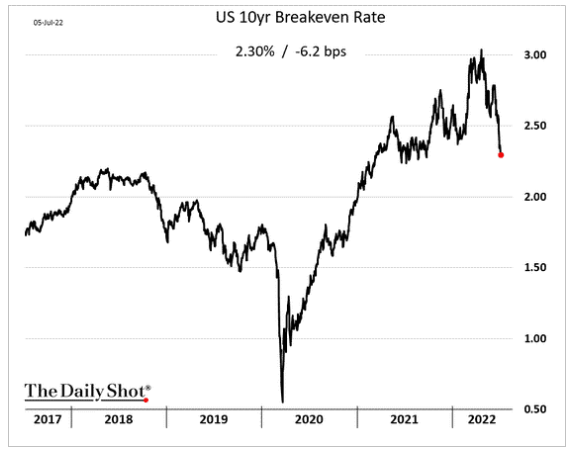

Interestingly, the market expectation of inflation over the next five years is now at its lowest point year-to-date, at about 2.5% annually, versus over 3% at the same point in early June, pre-Fed meeting. Expected inflation over five to ten years has sunk from almost 2.5% to 2.09% in the same timeframe – putting us almost exactly back to the Fed’s 2% long-term inflation target. It will take some time and additional interest rate increases to deliver this target.

How Does the Market Perform During an Economic Recession? You May Be Surprised

A recession is not the same as a down market: The stock market is based on expectations for the economy in six to twelve months and beyond, so stocks can move up during a recession—or down when the economy is expanding. By contrast, economic recessions or expansions may not be identified until months after they begin.

We grow more than we contract: Excluding the Great Depression, US recessions have lasted an average of about ten months. The Great Recession, which followed the global financial crisis, lasted eighteen months; the expansion that followed it is the longest on record, spanning more than ten years. The pandemic-induced recession in 2020, which lasted two months, is the shortest on record.

So, how do stocks perform when the economy is faced with a recession? The S&P 500 surprisingly rose, sometimes modestly, during almost all recession periods since 1945. That’s because markets tend to top out before the start of recessions and bottom out before their conclusion.

In other words, the worst is generally over for stocks before it is over for the rest of the economy. The S&P 500 has typically bottomed out roughly four months before the end of a recession and on average hits a high seven months before the start of a recession.

During the last four recessions since 1990, the S&P 500 declined an average of 8.8%, according to data from CFRA Research. In over half of the 13 years with recessions since World War II, however, the S&P 500 has actually posted positive returns.

Despite the increasingly gloomy outlooks that emerged on Wall Street after the U.S. economy contracted by 1.4% in the first quarter of 2022, economists still expect modest economic growth for the rest of this year. Should we enter a recession, it is likely to be shallow and short-lived because of the strength of the fundamentals.

A possible scenario would be a soft landing similar to what occurred in 1994. In that case, though stocks were negative for the year as the Fed raised rates seven times in 13 months, the economy still avoided a recession and stocks rebounded 34% in 1995.

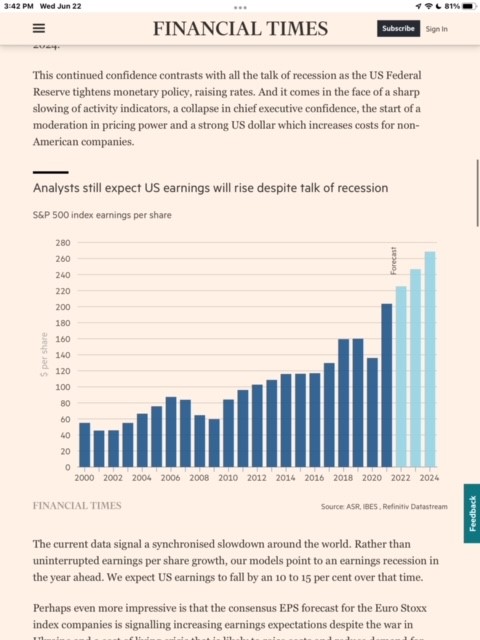

Corporate Earnings Are Strong and Growing

Market Timing Usually Does Not Work And Can Be Very Costly

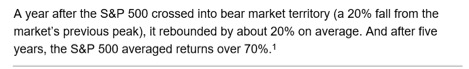

Recoveries After Sharp Declines Can Be Significant

FAMA/French Total US Market Research Index Returns

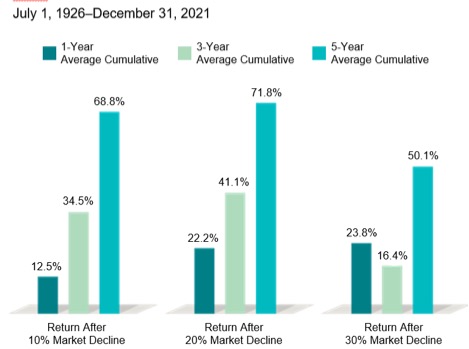

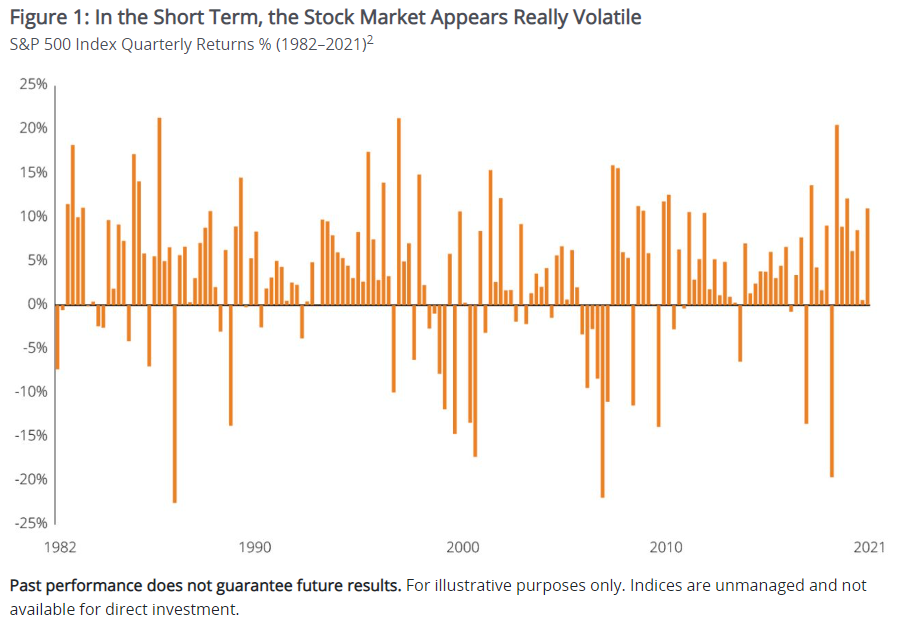

Volatility In Perspective:

The Labor Market Is Strong

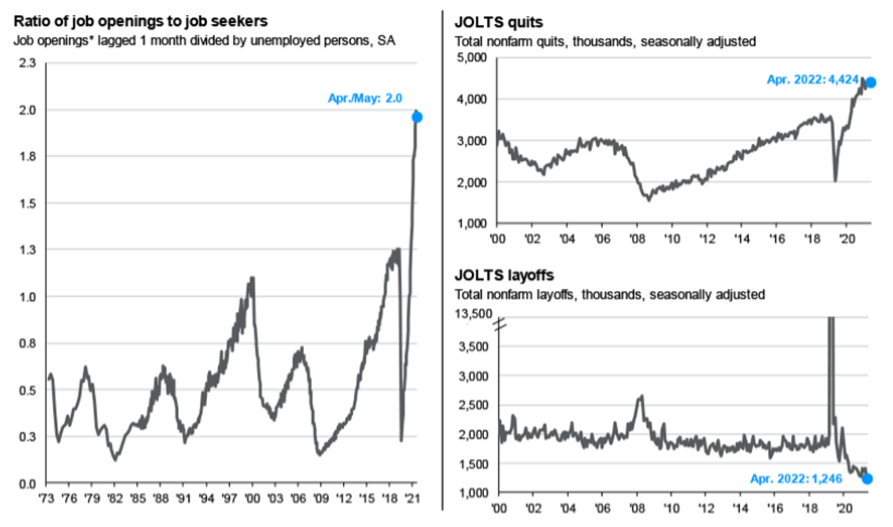

Payrolls have grown continually since January 2021, and job openings stand at a level nearly double the number of unemployed workers. Labor force participation was slow to recover last year, but has improved in 2022, albeit unevenly. Employment is especially important to track, as every recession has featured substantial job losses.

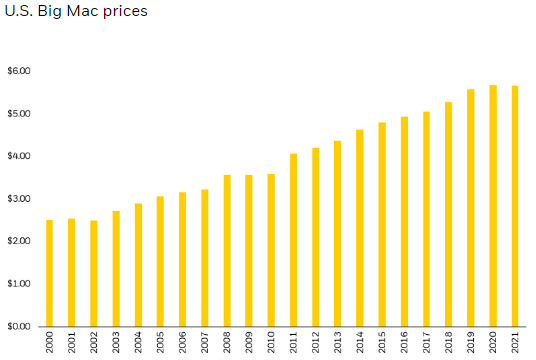

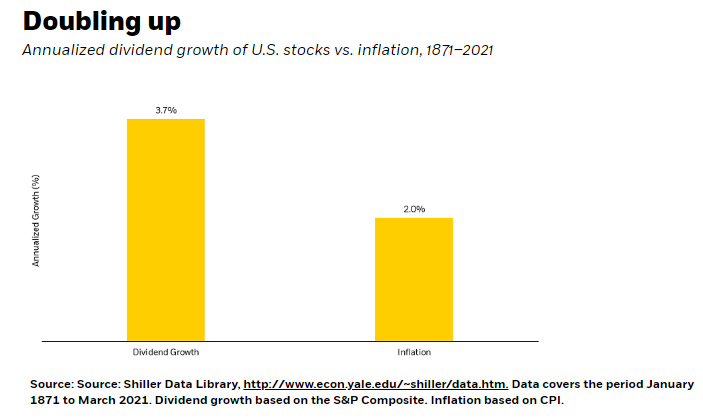

Companies Can Usually Pass on Increasing Costs to Their Customers. Equities Have

Been an Excellent+ Inflation Hedge

Dividends have kept well ahead of inflation

The Market Expects Inflation to Moderate Over Time:

Agricultural Product Prices Are Declining:

Gasoline Prices May Have Peaked:

U.S. Consumers Are Financially Healthy

Consumer spending is the largest driver of US economic growth. Today, it accounts for about 68% of US economic activity.

10 Facts About Equity Investing

A mental framework for investors.

The stock market can be an intimidating place: real money is on the line, there is an overwhelming amount of information, and people have lost fortunes very quickly. But it is also a place where thoughtful investors have long accumulated significant wealth.

The primary difference between those two outlooks is related to misconceptions about the stock market that can lead people to make poor investment decisions.

1. The long game is undefeated.

There is nothing the stock market hasn’t overcome.

“Over the long term, the stock market news will be good,” billionaire investor Warren Buffett, the greatest investor in history, wrote in an op-ed for The New York Times during the depths of the global financial crisis. “In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president.”

2. You can get smoked in the short-term.

Bull markets come with lots of bumps in the road. While the S&P 500 has usually generated positive annual returns and the long-term returns have exceeded 10% annually on average, it’s also seen an average drawdown (i.e. a decline from its high) of 14% during those years.

Bear markets can happen quickly, like the S&P 500’s 34% drop from February 19, 2020 to March 23, 2020; and they can happen painfully slowly, like the 57% decline from October 9, 2007 to March 9, 2009.

Investing for long-term returns means being able to stomach a lot of intermediate volatility.

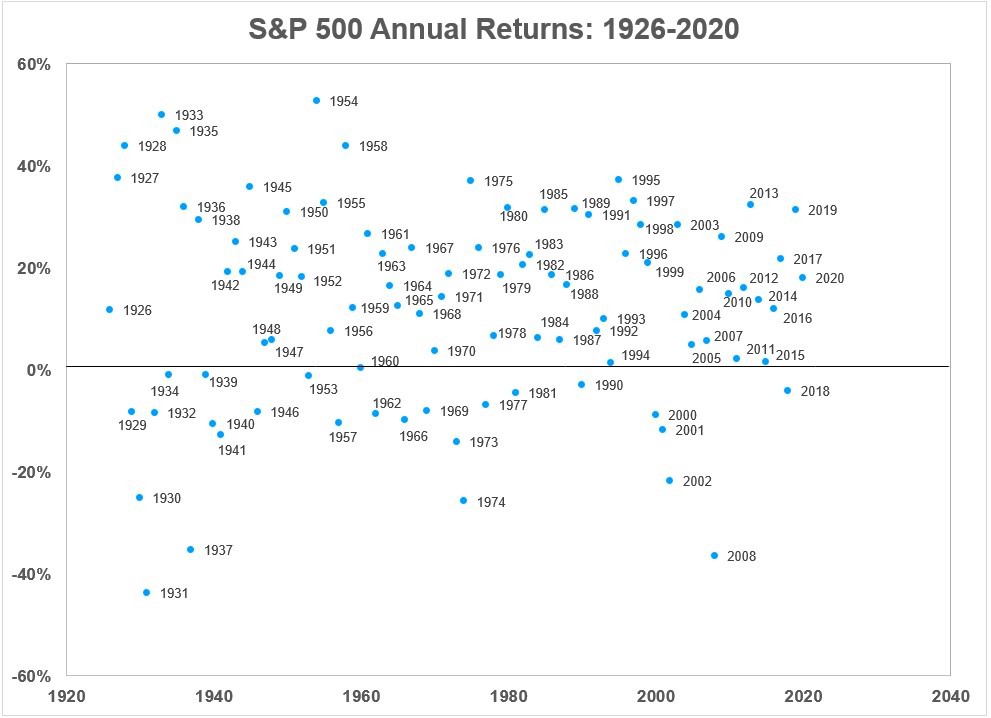

3. Don’t ever expect average.

At some point in your life, you probably heard that the stock market has generated over 10% annually on average. While that is true in the long run, the market rarely delivers an average return in a given year.

Check out the chart below which plots the S&P 500’s annual returns since 1926. If ten “percentish” returns were commonplace, you’d see a tight horizontal line of dots just above the x-axis.

This chaotic mess of dots illustrates just how difficult it is to predict what next year’s returns are going to be. This holds true even if you know exactly what’s going to happen in the economy. Outside of the Great Depression and the Global Financial Crisis, it’s difficult to make out history’s major economic booms and bust. The good news is that there are many more dots above the black line than below. Indeed, stocks usually go up.

4. Stocks offer asymmetric upside.

A stock can only go down by 100%, but there’s no limit to how many times that value can multiply going up. From its low of 666 in March 2009, the S&P 500 is up more than eight times (8x) today.

5. Earnings drive stock prices.

Any long term move in a stock can ultimately be explained by the underlying company’s earnings, expectations for earnings, and uncertainty about those expectations for earnings. News about the economy or policy moves markets to the degree they are expected to impact earnings. Earnings (a.k.a. profits) are why you invest in companies.

6. Valuations won’t tell you much about next year.

There are many valuation methods that will help you estimate whether a stock or stock market is cheap or expensive. While valuation methods may tell you something about long-term returns, most tell you almost nothing about where prices are headed in the next 12 months. Over short periods like this, expensive things can get more expensive and cheap things can get cheaper. It is worth noting that prices can be cheap or expensive for extended periods of time. There are always those who explain why stocks are overvalued and that a steep correction is imminent. Ignore the doom-and-gloomers: Even a broken clock gets it right twice a day.

7. There will always be something to worry about.

Investing in stocks is to own a volatile group of assets, which is why the returns are relatively high. The high returns that equity investing can provide is a reward for enduring that volatility. Even in the most favorable market conditions, there will always be something keeping the most risk-averse folks on the sidelines.

8. The most destabilizing risks are the ones people aren’t talking about.

Surveys of market participants will yield lists of top risks, and ironically the most commonly cited risks are the ones that are already priced into the markets. It’s the risks no one is talking about or few are concerned about, that will rock markets when they come to surface. The market pricing system takes into account all risks known and knowable – it is the unexpected ones, the “surprised and shocks” that cause significant market interruptions.

9. There is a lot of turnover in the stock market.

Just as most businesses don’t last forever, most stocks aren’t in the market forever. The major indexes see lots of turnover (i.e. failing businesses get dropped and up-and-coming businesses get added). In fact, it’s the addition of new and unexpected companies that have been driving much of the market’s returns over the past decade.

10. The stock market is and isn’t the economy.

While the U.S. stock market’s performance is closely tied to the trajectory of the U.S. economy, they’re not the same thing.

The economy reflects all of the business being conducted in the U.S. while the market reflects the performance of the biggest companies — which typically have access to lower-cost financing and have the scale to source goods and labor more cheaply. Importantly, many of these bigger companies that make up the stock market do at least some business overseas where growth prospects may be better than in the U.S. The chart below shows the duration (width) and magnitude (height or depth) of bull and bear markets going back to 1942. Note the vertical bars which represent recessions and the fact that bull markets come about without any real correlation to the bull v. bear status at the time.

Why would one be concerned about bear markets (in orange) when you get to participate in all the bull markets (in blue)? Bear markets can indeed be painful. It never feels good when your account value is negative. However, we suggest you zoom out and look at the broader context. History shows us that any bear market is soon to be followed by an even stronger bull market. History is solidly on the side of the bulls.

Many clients are concerned about bear markets, but that’s only because they don’t understand how bull markets will compensate them over time. May this chart provide perspective.

The bottom line

There will always be a reason to feel like it might not be the right time to invest. Every day, week, month, or year there will be a crisis or issue that seems to threaten the viability of markets. Despite this uncertainty, markets have proven resilient to all the challenges and obstacles for more than a century.

Words of wisdom from Sahil Bloom to his about-to-be born son

“I’ve always considered myself something of an introspective individual—I try to reflect regularly on my motivations, mistakes, learnings, principles, and frameworks. I find that the act of reflection provides value—it helps the good stick and the bad wither. So perhaps it isn’t all that surprising that the news of my upcoming responsibility raise—to that of “Dad”—has taken my introspection to another level.

With that in mind, I sat down recently to sketch out a long list of principles of life—formed through my failures, missteps, stumbles, and successes—that I hope to be able to teach my child as they grow up. With that as a backdrop, here are the 20+ principles I hope to teach my child to live by…”

Thank you for entrusting your nest-egg to our stewardship. Please contact us if there is any change in your situation that impacts the allocation of your portfolio or any other aspect of your financial life that you wish to have us review with you. As trained Personal Financial Planners, our team stands ready to provide guidance and counsel in all related matters.

Sincerely,

Your RVW Wealth Team: Selwyn Gerber, Jonathan Gerber, Stephen Seo, Loren Gesas, Ofer Ben-Menahem, Mary Ann Moe, Simon Liu, Jesse Picunko, Kelly Sueoka, Dylan Scott, Lisa Blackledge, Teresa Green, Shelly Moore, Anita White, Simmons Allen, Yehoshua Wyne, Morgan Vickers and Kelly Richardson.

FOR IMPORTANT CURRENT COMPLIANCE AND DISCLOSURE INFORMATION GO TO http://www.rvwwealth.com/compliance

NOTE: The information provided above is not complete, may be erroneous, and omits important data. The charts are estimates and may contain inaccuracies or distortions.

Read and rely exclusively on actual offering documents and on statements received directly from your custodian. Investments are not guaranteed and may lose value. Past performance is not indicative of likely future returns.