Bear Markets Explained in 7 charts, 3 quotes and an article: Everything You Need to Know.

Equity markets in general are down around 25% so far this year – led downwards by sectors such as technology (40%), healthcare (32%) and consumer discretionary (30%).

Some of the most popular and storied companies fared the worst – Peloton, Beyond Meat, Shopify, Roku, Rent the Runway, Rite Aid, Lyft, DocuSign, Doordash and Warby Parker are all down by over 70%. Tesla and Facebook, for example, are currently worth around one-half of their peak prices.

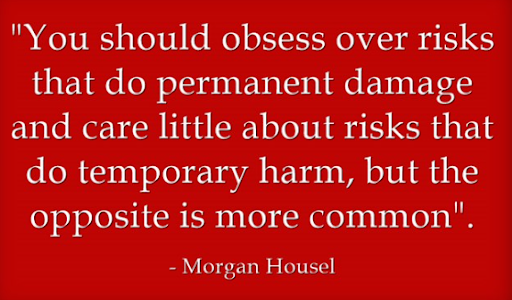

We have seen this play before – the storyline is different each time, but the ending is the same: The bulls crush the bears. It may seem tempting to pull money out of the market to protect it; but moving to the sidelines could be even riskier than staying invested because timing re-entry into the market is incredibly difficult. Market timers need to get two decisions right: When to get out and when to re-enter – a nearly impossible task. Historically, 78% of the market’s best days occurred during bear markets before it was clear a new bull had begun. Being out of the market will likely mean missing out on its turnaround and turning temporary declines in value into permanent losses.

Stocks are currently facing 3 fundamental stresses:

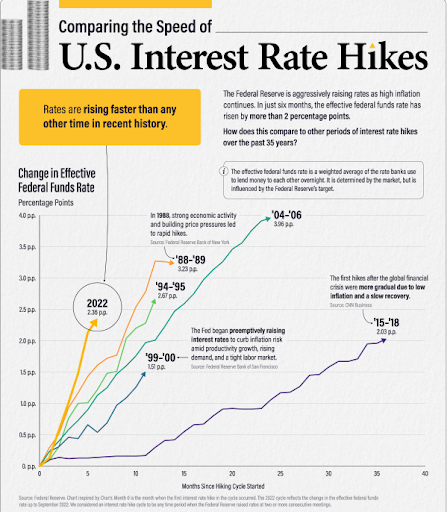

* Inflation caused by the massive liquidity pumped into the economy and into the hands of consumers and by the impact of the Russian invasion of Ukraine;

* High-interest rates caused by a very aggressive Fed, seeking to dramatically slow down inflation, seemingly regardless of cost; and

* A rapidly rising dollar value which reduces profitability of the largest companies because foreign earnings translate into fewer dollars.

RVW portfolios are designed with the knowledge that bear markets develop without warning and therefore we seek to ensure that equities are viewed as longer term holdings because markets do well over time but (as we see) not all the time. Our educational process informs our investors of the volatility inherent in equity investing, the generous rewards that have inured to those who withstood it – and the risks of exiting when markets are down.

The RVW process for selection of equities is rules-based. We think of it as a Darwinian Wealth Optimization System – constantly seeking to own fractional interests in superior companies that are profitable, stable, and growing. Changes are made in real time through periodic reconstitutions of holdings as needed to comply with the criteria of each ETF. Remember: Markets come and go – quality endures.

The long game is undefeated

“Over the long term, the stock market news will be good,” billionaire investor Warren Buffet, the greatest investor in history, wrote in an op-ed for The New York Times during the depths of the global financial crisis in 2008. “In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation for a disgraced president. Yet the Dow rose from 66 to 11,497.” (Note: The Dow is currently around 30,000)

There’s nothing the stock market hasn’t overcome eventually. Time is the friend of the good investment and the enemy of bad, opines Buffett.

The following charts will help to provide perspective as we traverse difficult market conditions:

CHART #1: BEAR MARKETS ARE PART OF THE NORMAL RECURRING INVESTMENT CYCLES. THEY ALL END.

Ten bear markets in 40 years means that they recurred roughly every 4 years in the past.

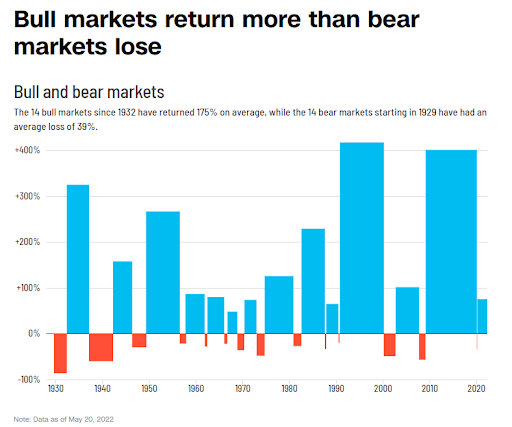

CHART #2: RECOVERIES HAVE BEEN STRONG.

Every bear market has ended in a powerful surge upwards.

CHART #3: THE RISK OF BEING OUT OF THE MARKET IS TO MISS THE DAYS WHEN MARKETS HAVE RISEN SIGNIFICANTLY.

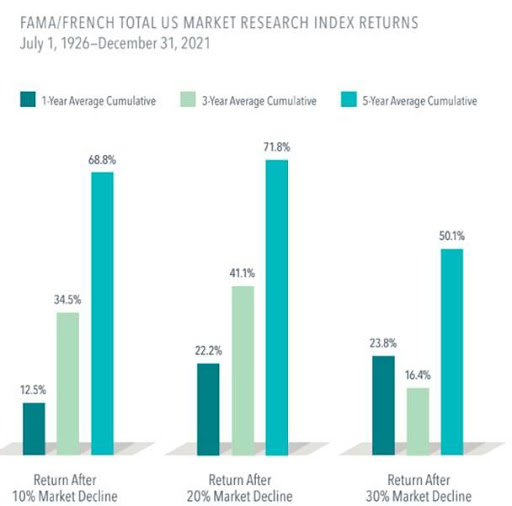

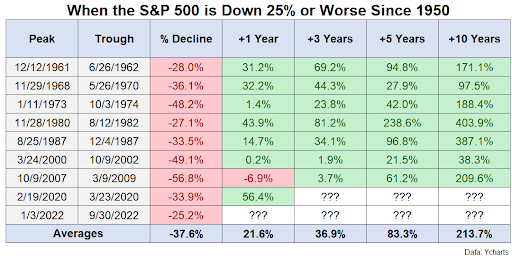

CHART #4: RECOVERIES HAVE BEEN SWIFT, SHARP AND ENDURING AFTER SIGNIFICANT DECLINES:

CHART #5: INTEREST RATES ARE BEING LIFTED AT THE FASTEST RATE IN HISTORY:

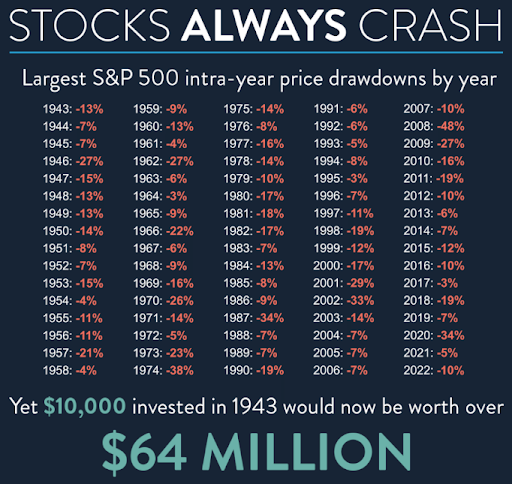

CHARTS #6 & 7: HOLDING ON THROUGH TOUGH TIMES HAS BEEN VERY REWARDING:

THE NARRATIVE:

READ THIS ARTICLE THAT JUST APPEARED IN A PROMINENT AUSTRALIAN FINANCIAL PUBLICATION

AND REFERS TO PRECISELY THE STYLE OF INVESTING WE EMPLOY.

IN FACT, IT’S WHY WE’RE CALLED RVW WEALTH.

Awaken to Rip Van Winkle Investing

Rip Van Winkle investing is the idea of owning investments of such high quality that one could sleep for 20 years and wake up confident that the investments have thrived.

By Philip Bish·16 Sep 2022

Investing insights from experts

Rip Van Winkle is a short story written in 1819 about a Dutch American who wandered off with his dog into New York State’s Catskill mountains to escape his wife’s scolding. There he met a group of dwarves who were playing ninepins. The dwarves offered Van Winkle some liquor, and after taking a few drinks, he fell asleep.

Twenty years later, he awoke to find that his beard had grown a foot long, his wife had died, his kids had grown up, and that he had completely missed the American Revolution.

Rip Van Winkle Investing

The Rip Van Winkle approach to investing, is an idea popularized by Warren Buffett. It suggests that people should buy investments of such high quality, that they could sleep for 20 years and awaken confident that their investments have flourished.

Buffett has long believed that if you can’t own a stock for ten years, you shouldn’t own it for ten minutes. He said, ‘Searching for the superstars offers us our only chance of real success. Charlie and I are simply not smart enough to get great results by adroitly buying and selling portions of far-from-great businesses. Nor do we think many others can achieve long term investment success by flitting from flower to flower’.

Buffett has utilized this approach, holding for decades companies such as American Express, Coca-Cola, See’s Candies, Dairy Queen and Geico.

ETFs

The Rip Van Winkle approach to investing aligns perfectly with owning broad based ETFs or well managed active funds.

In fact, if Rip had bought into the Australian market via a broad-based ETF 20 years ago, he would have done very well.

Let’s say that in September 2002, Rip had bought $100,000 worth of an ETF that tracked the S&P/ASX 200 Accumulation index (where all dividends are reinvested), today that same investment would be worth around $510,000.

The reason for this great result, is that when we combine great average returns with long periods of time, the power of compounding will produce extraordinary outcomes.

According to Vanguard, over the past 30 years Australian shares have returned on average 9% p.a. (including dividends). US shares have performed slightly better returning 10% p.a. over the same period.

Why Rip Van Winkle investing works

The reason why this style of investing works so well, is that ‘time in the market’ will always beat ‘timing the market’. And when people invest for the long-term, it helps take some of the emotion out of investing.

The kicker to holding investments for the long-term is that it also saves on costs. The continual buying and selling of stocks will attract brokerage fees and brings forward capital-gains tax.

A further advantage of Rip Van Winkle investing is that by investing for the long term, you won’t need to check your share prices daily.

Studies have shown that people who look at their portfolios daily, tend to trade more and thus accrue more costs. Also, looking at share prices daily can be stressful, especially in down markets.

Rip Van Winkle investing provides many benefits, but one of the best, is that it should give you a good night’s sleep.

NOTE: THE WRITERS ARE COMPLETELY UNCONNECTED WITH, AND UNAWARE OF RVW WEALTH LLC.

Thank you for entrusting your nest-egg to our stewardship. Please contact us if there is any change in your situation that impacts the allocation of your portfolio or any other aspect of your financial life that you wish to have us review with you. As trained Personal Financial Planners, our team stands ready to provide guidance and counsel in all related matters.

TAX LOSS HARVESTING: Over the past several months you may have noticed that we have been trading certain of your positions more frequently than we normally do. That has been primarily because of us locking in a potentially tax-beneficial loss – and replacing the investment with an alternative that is economically similar. That allows us to “tax loss harvest” – a classic way to turn lemons into lemonade.

INVESTING IN ALTERNATIVES: Over the past year we have been selectively introducing investments in income producing real estate funds and private credit funds to enhance cash flow and diversify into uncorrelated or low-correlated investments. These have done remarkably well, and we plan to expand our exposure to these categories. If you wish to include this category in your portfolio, please contact us immediately.

Sincerely,

Your RVW Wealth Team: Selwyn Gerber, Jonathan Gerber, Stephen Seo,Loren Gesas, Mary Ann Moe, Simon Liu, Lisa Blackledge, Jesse Picunko,Ofer Ben-Menahem, Dylan Scott, Teresa Green, Shelly Moore, Simmons Allen, Morgan Vickers, Kelly Sueoka, Yehoshua Wyne, Erik Stevens, Jeff Farrell, Drew Wallis, Denise Magilnick, and Kelly Richardson.

FOR IMPORTANT CURRENT COMPLIANCE AND DISCLOSURE INFORMATION GO TO http://www.rvwwealth.com/compliance

NOTE: The information provided above is not complete, may be erroneous, and omits important data. The charts are estimates and may contain inaccuracies or distortions.

Read and rely exclusively on actual offering documents and on statements received directly from your custodian. Investments are not guaranteed and may lose value. Past performance is not indicative of likely future returns.