Stock market timing, or the practice of trying to predict when to buy and sell stocks in order to maximize profits, can be a tempting strategy for investors. After all, who wouldn’t want to sell at the top and buy at the bottom? However, the reality is that stock market timing is a perilous pursuit that often leads to significant losses.

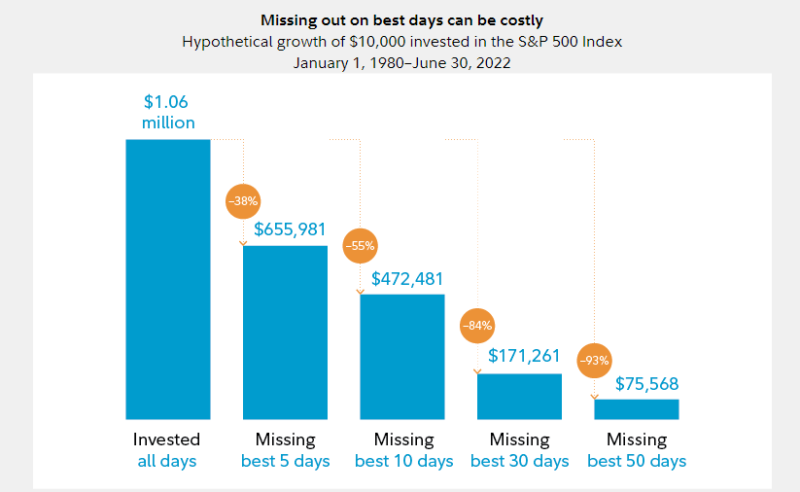

There are several reasons why stock market timing is so difficult. First, it requires a level of market forecasting that is simply not possible. No one can predict with certainty what the market will do in the short term, and even the most experienced analysts and investors are often wrong. Second, even if you are able to make a successful market timing decision when selling, if one misses the upswing and doesn’t re-enter the market, the strategy fails.

“The biggest problem is that both decisions have to be right – getting out and getting in”.

While you may be able to avoid losses by selling at the right time, you may also miss out on potential gains if the market continues to rise. In addition, the constant focus on short-term movements can distract from the long-term goals of your investment strategy.

Ultimately, the best approach for most investors is to adopt a long-term, diversified investment strategy and to avoid the temptation of trying to time the market. This means holding a mix of assets, such as stocks, bonds, and cash, and being patient through the ups and downs of the market. While it may not be as exciting as trying to predict the next big move, it is a much more reliable and sustainable approach to building wealth over time.