International investing in equities, or stocks, can offer a number of potential benefits for investors.

First and foremost, international investing can help diversify an investment portfolio. By investing in a range of companies in different countries, investors can potentially reduce the overall risk in their portfolio, as the performance of companies in one country may not be directly correlated with those in another. This can be especially important in times of economic downturn, as a diversified portfolio may be better able to weather market volatility.

Another potential benefit of international investing is the opportunity to tap into the growth potential of emerging markets. Many developing countries have burgeoning middle classes and are experiencing rapid economic growth, which can create attractive investment opportunities.

“International investing can provide access to a wider range of industries and sectors. Some of the world’s leading companies like Nestle, Unilever, Toyota and Anheuser-Busch for example, are located abroad.”

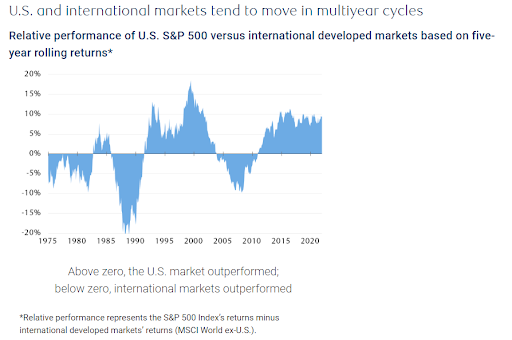

U.S. versus international performance trends have moved in bunches. Both groups jockeyed back and forth with the U.S. outperforming for a number of years, and then international stocks took the mantle and led the way. During this time, the U.S. recorded three dominant periods of outperformance and international stocks also enjoyed three instances of ascendance, all of which had varying magnitudes and durations.

International investing can reduce volatility and improved returns over time, and are a key attribute of an optimally designed long term equity portfolio.