All three main U.S. equity benchmarks finished the first quarter in the green.

U.S. stocks have shrugged off a number of challenges since the start of the year, powering through the worst U.S. bank failures since the 2008 financial crisis, while resisting the turbulence of volatile short-term Treasury yields. A widely anticipated recession has failed to materialize, at least so far. The labor market has remained robust, even with a pickup in layoffs in the technology sector in recent months; and inflation, while still high, has continued to ease. In the face of significant uncertainty, markets proved to be more buoyant than many thought possible.

The biggest shock of the quarter came in March, when Silicon Valley Bank and Signature Bank collapsed, and bank stocks tumbled. Credit Suisse Group AG came to the brink of failure, forcing rival UBS to arrange a hasty takeover. The biggest U.S. banks scrambled to shore up First Republic Bank to stop growing panic from taking down more lenders.

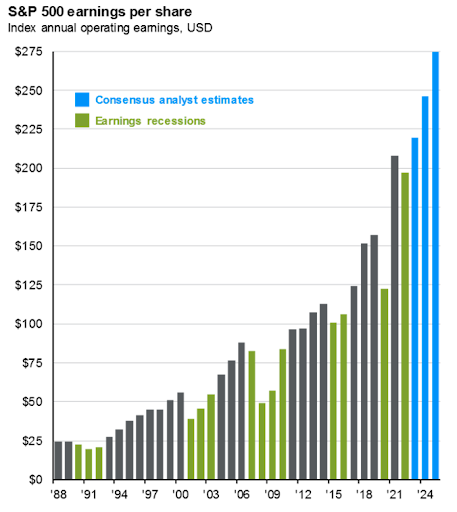

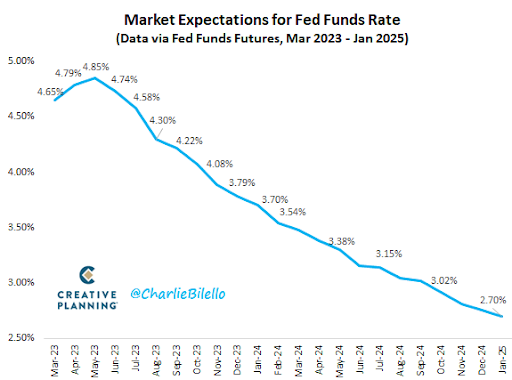

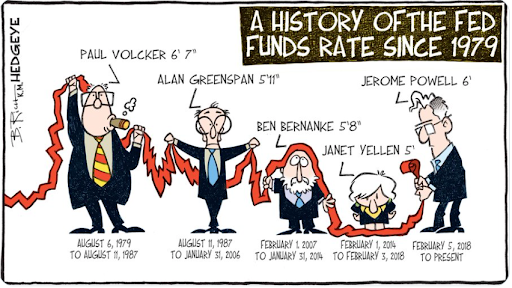

Futures markets indicate that the federal-funds interest rate will peak at around 4.9% in May, then fall to about 4.4% by the end of the year. Corporate earnings are expected to decline briefly and then rise.

CORPORATE EARNINGS ARE EXPECTED TO GROW AFTER A BRIEF DIP.

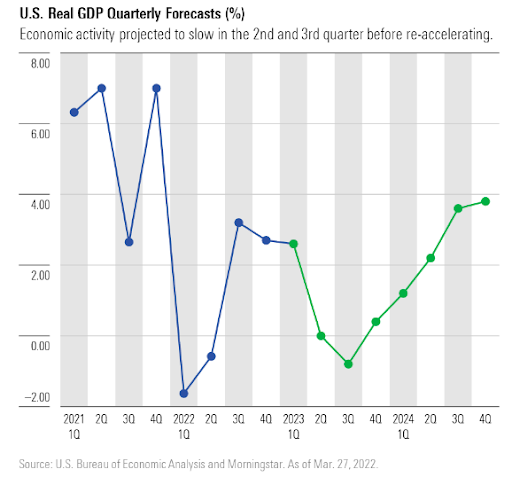

THE ECONOMY SHOULD DECLINE AND THEN RECOVER

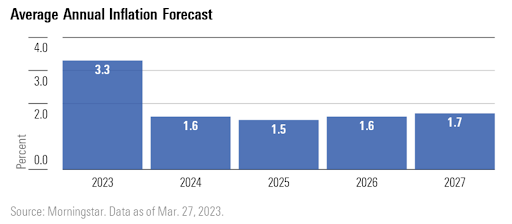

INFLATION IS RECEDING:

Inflation seems to have peaked in 2022 and is expected to be benign in 2024 and beyond.

US inflation continues to moderate: year-on-year growth in the consumer price index has shrunk from a peak of 9.1% in June 2022 to just below 5% currently. For the first time since January 2021, energy is cheaper than it was last year thanks in large part to the call in energy prices since their initial runup caused by the Russian invasion of Ukraine. Prices for core manufactured goods have also stabilized as supply chains improve, with falls in used car prices nearly fully offsetting rises in other goods.

INTEREST RATES TO COME DOWN AFTER ONE MORE HIKE

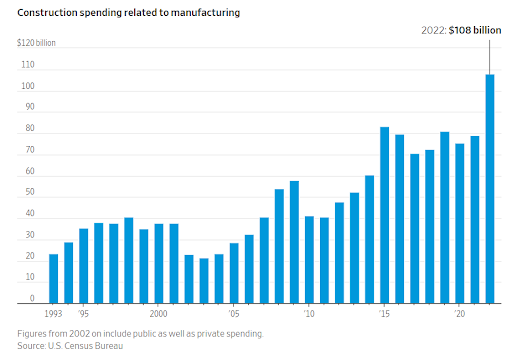

MANUFACTURING IS COMING BACK

New factories are rising in urban cores and rural fields, desert flats and surf towns. Much of the growth is coming in the high-tech fields of electric-vehicle batteries and semiconductors, national priorities backed by billions of dollars in government incentives. Other companies that once relied exclusively on lower-cost countries to manufacture eyeglasses and bicycles and bodybuilding supplements have found reasons to come home.

See this from the Wall Street Journal: America Is Back in the Factory Business

PRESCIENT OR COINCIDENCE?

HISTORY IS ON THE SIDE OF THE BULLS:

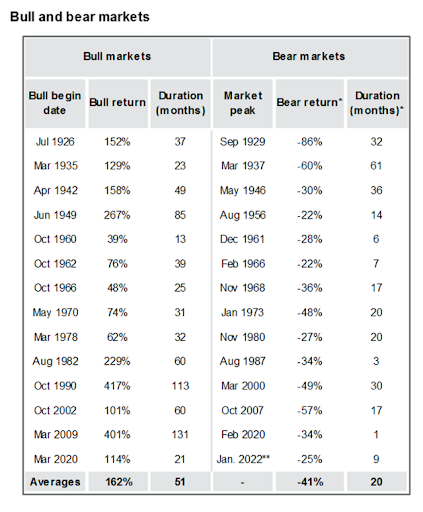

“Bull markets climb a wall of worry; bear markets slide down a river of hope”.

This is one of the most famous Wall Street truisms. Nobody knows who originally said this, but it rings true through the decades. Simply put, it means every bull market in stocks is doubted by a cadre of naysayers. There is always a vocal group of skeptics who point out a myriad of very rational and quite possible potential events which could derail the market’s ascent. In this sense, during a bull market, stocks are said to “climb a wall of worry”. Bull markets end when the last holdout doubters finally throw in the towel, when FOMO—Fear of Missing Out—gives in to greed and the last dollar is invested in the market. The constant drip, drip, drip of daily negative news is another brick in this massive wall of worry, which the optimists of the world try to overcome. This is an oversimplification of a very complicated process, but it holds true.

One of the best reasons to be bullish may be that very few people are. Recent sentiment polls show a high number of bears, while worries about the economy and earnings continue to expand. Think back to March 2003, March 2009, and March 2020. Those were all scary times; yet stocks made major lows in those years and they marked the beginning of the next up-leg of equity prices. In 2003, the war in Iraq started after a three-year bear market; the global financial crisis was underway in 2009 and stocks dropped by half; and in 2020 the world shut down due to COVID-19. None of these periods felt like good times to look to a brighter future, but they all were.

When investors are bearish, few sellers remain. That means any good news could spark a rally because the bad news is already priced into the market. Potential sparks this time include: an increase in FDIC insurance; a Fed that is nearly done hiking; inflation continuing to decline; stronger earnings from corporate America; a consumer that continues to drive the economy; and the recent banking crisis not expanding past a few badly positioned banks.

Volatility is the price equity investors have paid for the extraordinary returns they have enjoyed over time.

The chart below puts bull and bear markets in perspective: Bull markets delivered about 4 times the decline of bear markets.

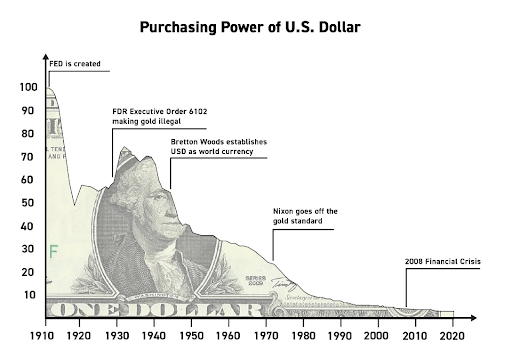

WHY INVESTORS MUST TAKE INFLATION INTO ACCOUNT:

FEATURED VIDEO: Professor Jeremy Siegel on “Stocks for the Long Run” and Current Market Conditions – Click Here:

“Stocks for the Long Run” is the essential textbook for every investor. Hear Prof. Siegel discuss his latest findings in this video.

“Should command a central place on the desk of any ‘amateur’ investor or beginning professional.” ―BARRON’S

“Siegel’s case for stocks is unbridled and compelling.” ―USA TODAY

“A clearly written, neatly organized, highly persuasive exposition that lifts the veil of mystery from investing.” ―JOHN C. BOGLE, founder and former Chairman, The Vanguard Group

FEATURED PODCAST: Rules of the Money Game – The Morgan Housel Podcast

“There are only a handful of financial rules, ideas, and observations that really move the needle — and explain the majority of what you need to know to do better with your money. I could have narrowed this down to 10, but I had fun with this thought experiment, so here are my top 30 rules of the money game”.

Listen on Apple Podcasts: https://podcasts.apple.com/us/podcast/the-morgan-housel-podcast/id1675310669?i=1000604218932

FEATURED FACTOR

The science of capital markets employs evidence-based investing in portfolio design. Selecting factors (attributes) in groups of companies has been shown to deliver superior expected returns to those of active managers (seeking to pick winning stocks and to time the buying and selling).

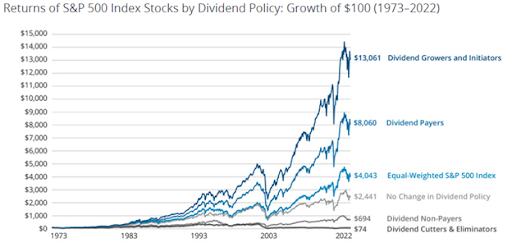

Why We Favor Dividend Growers

Dividend-paying securities must have actual earnings and cash flow to distribute to shareholders – or else their dividend payments would not be possible. This means that dividend stocks exclude the riskiest securities: ‘pre-earnings’ startups and businesses experiencing bankruptcy or other financial distress.

Dividend payers generate a constant stream of cash for investors that can be deployed into new investment opportunities. This dividend income stream is generally more constant than stock prices are, which means investors can buy more stocks when stock prices are low. The stability of dividend payments also has a ‘smoothing’ effect on long-term portfolio performance. In research performed by Ned Davis and Hartford Funds, it was found that dividend growers and initiators delivered superior long-term total returns with less volatility.

We all work with an array of professional experts throughout our lives, almost all of whom we expect to adhere to a certain basic ethical standard, one that allows arm’s length dealings and no hidden motives.

- We expect our doctors to faithfully follow the Hippocratic Oath.

- We expect our attorneys to advocate vigorously for our best interests.

But what would you do if you found out that your doctor accepted kickbacks or incentives from a pharmaceutical company to prescribe drugs with harsh side effects or limited efficacy, when a better or less costly solution might be available? Or owned a share of the pharmacy to which he referred you? What would you think if you found out that your attorney had hired her inexperienced family member as an expert witness in your case, rather than someone generally presumed to be a true expert in the field?

Hidden fees, undisclosed commissions, and obligations to outside firms can take a huge chunk out of your portfolio. That can have a substantial impact on major life decisions, like when and where you retire, and your ability to take care of your children and grandchildren. Disclosures are made, but often in very small print. At RVW we proudly have no small print.

Frequently when we speak to prospective clients, they believe their brokers are fiduciaries. However, that is typically not the case, because most big banks and brokerages are not true fiduciaries. Many claim to be wearing “both hats” – providing fiduciary care some, but not all, of the time.

To avoid being duped, an astute investor should ask, “Will you serve me and my family as a fiduciary? Are you bound by the fiduciary standard?” If the answer to both is anything other than “Yes,” that should give you pause.

RVW LifeWisdom from Matt Haig’s Reasons to Stay Alive:

The world is increasingly designed to depress us. Happiness isn’t very good for the economy. If we were happy with what we had, why would we need more? How do you sell an anti-aging moisturizer? You make someone worry about aging. How do you get them to buy insurance? By making them worry about everything. How do you get them to have plastic surgery? By highlighting their physical flaws. How do you get them to buy a new smartphone? By making them feel like they are being left behind.

To be calm becomes a kind of revolutionary act. To be comfortable with our messy, human selves, would not be good for business.

Yet we have no other world to live in. And, when we really look closely, the world of stuff and advertising is not really life. Life is what is left when you take all that stuff away, or at least ignore it for a while.

Thank you for entrusting your nest-egg to our stewardship. Please contact us if there is any change in your situation that impacts the allocation of your portfolio or any other aspect of your financial life that you wish to have us review with you. As trained Personal Financial Planners, our team stands ready to provide guidance and counsel in all related matters.

Your valuable feedback is important. Please take a moment and give us a review on Google (click here).

Sincerely,

Your RVW Wealth Team:

Selwyn Gerber, Jonathan Gerber, Loren Gesas, Mary Ann Moe, Simon Liu, Lisa Blackledge, Jesse Picunko, Dylan Scott, Teresa Green, Shelly Moore, Simmons Allen, Morgan Vickers, Kelly Sueoka, Shuey Wyne, Erik Stevens, Drew Wallis, Denise Magilnick, and Kelly Richardson.

FOR IMPORTANT CURRENT COMPLIANCE AND DISCLOSURE INFORMATION GO TO http://www.rvwwealth.com/compliance

NOTE: The information provided above is not complete, may be erroneous, and omits important data. The charts are estimates and may contain inaccuracies or distortions.

Read and rely exclusively on actual offering documents and on statements received directly from your custodian. Investments are not guaranteed and may lose value. Past performance is not indicative of likely future returns.