Taurus is Back: SEVEN CHARTS & SIX REASONS FOR OPTIMISM

Stocks have rebounded strongly from their worst year since 2008, returning to a bull market in the US. Inflation fell and the Fed paused after a year of aggressive rate increases. Artificial intelligence has captured investors’ attention and is expected to be transformative to the entire economy. The benefits of a steady hand at the tiller again inured to the benefit of RVW investors. Our broadly diversified quality-focused equity portfolios demonstrated resilience and delivered solid double-digit returns, almost entirely free of current income taxes.

The widely anticipated recession for 2023 – and the accompanying bear market – is still missing in action. Wall Street forecasters were caught flat-footed by how the first half of 2023 unfolded in financial markets. Ironically, the fact that the recession was widely expected and telegraphed ahead of time, resulted in corporate America planning for it by adjusting inventory levels and making other strategic moves, thus minimizing its effect.

It has been said that bull markets “need to climb a wall of worry.” So far, the year has given investors plenty of concerns to process including three of the four largest bank failures on record, the debt ceiling uncertainty, the ongoing Ukraine war, tensions with China, a significant decline in the money supply (M2), and elevated interest rates—and yet, much to celebrate with the return of Taurus.

The economy and the jobs market turned out to be far less sensitive to interest rates and geopolitical turmoil than economists expected. Most companies and consumers had locked in long-dated loans with low rates during the pandemic; household savings took time to run down, and wages grew faster than inflation. Energy prices have declined as U.S. domestic production soared, Europe secured supplies to replace Russian gas more easily than expected and their winter was milder than anticipated. Indeed, prices for most commodities have moved lower this year with copper and natural gas among the most significant. All these factors supported consumption and business activity. The transformation from consumer focus on goods to services—from acquiring “stuff” to spending on experiences – has impacted the economy, and sectors such as travel, hospitality and restaurants have thrived. On the other hand, while most parts of the real estate sector have benefitted from the pandemic, office buildings and shopping malls have foundered, and we await the next shoe to drop in the banking system as commercial mortgages go into default.

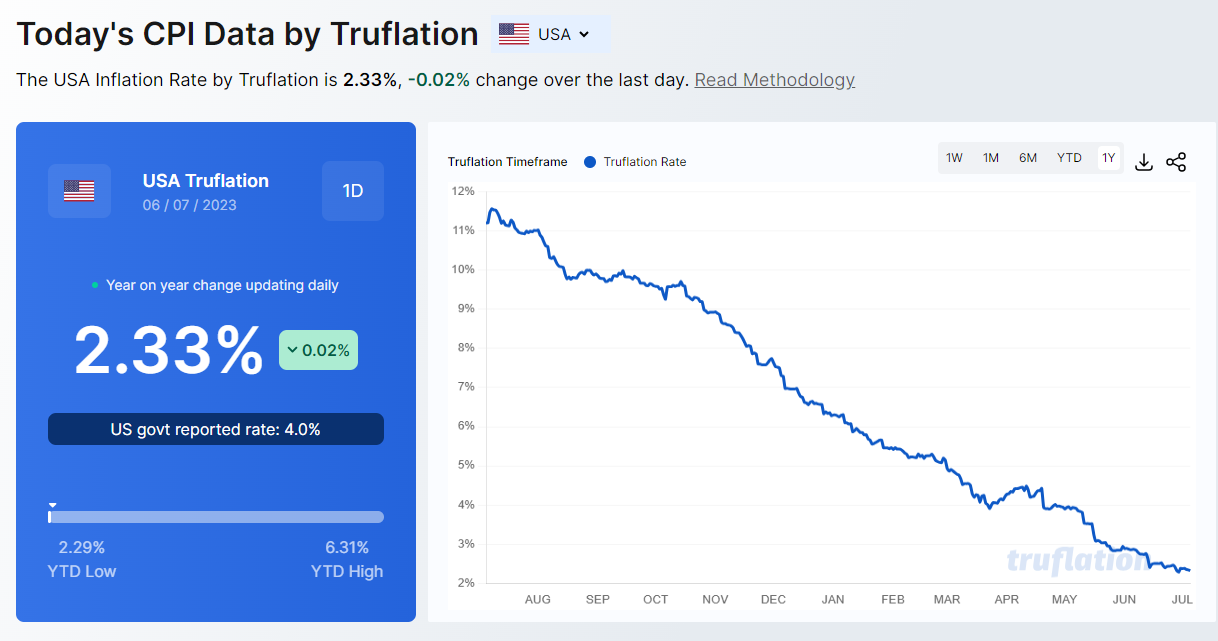

The fundamental backdrop for the economy is that inflation, while making progress, continues to run above the Fed’s target and the labor market remains strong. As a result, the Federal Reserve is deliberately and forcefully trying to weaken the economy, a strategy it believes is required to beat inflation. Having missed the return of fundamental inflationary forces which were described as “transitory”, the Fed seems to be erring again—this time possibly overshooting the mark on interest rate rises. As is apparent from the data, inflation is already trending downwards. An expected headwind is the upcoming student debt repayment process which is slated to begin next month. As of the end of Q1-2023, almost $1.8 trillion in student loan debt was owed by 40 million borrowers, to be repaid over 10 years – representing an average monthly payment per borrower of $390.

Despite the Fed’s efforts to slow down hiring, soften consumer demand and tame inflation, corporate earnings have demonstrated resilience and the economy remains robust. What matters most for the pricing of equities and other risk assets is the strength of corporate profits and the longer, 10-year Treasury yield.

The positive forces outlined below are more powerful than the headwinds, although the road upwards is likely to be bumpy. It is important to note that earnings are backwards looking, reflecting past performance, whereas stock market pricing is forward looking- and is apparently already focused on the period beyond the current “high inflation / high interest rate/ possible slowdown ahead” environment.

THE MAGNIFICENT SEVEN

You may have heard about the Magnificent Seven in recent weeks. It’s not a reference to the classic Western film but instead to the seven stocks that have been behind a large percentage of the stock market gains this year. These companies were among the poorer performers last year, and came roaring back, to the surprise of many. The Magnificent Seven are not all in the tech sector, but those that aren’t are nonetheless tech-adjacent (their business is driven in large part by advances in hardware, software, and data crunching). Collectively these stocks (Apple, Alphabet, Tesla, Amazon, Microsoft, Meta and Nvidia) account for almost all the market gains this year.

By contrast, solid, blue chip, defensive stocks outside the tech sector have mostly languished, the S&P SmallCap 600, which includes none of the seven, has grown just 3.6% this year and the Dow returned just 3.8%. Developed international stocks, as represented by the MSCI World ex USA Index, added 13.0%, while emerging markets lagged, with the MSCI Emerging Markets Index up only 8.8%.

THE 6 REASONS FOR LONG TERM OPTIMISM

- The budgeted $2 trillion of direct spending from Washington in three bills: (1) the Infrastructure Investment and Jobs Act, (2) the Creating Helpful Incentives to Produce Semiconductors and Science Act, and (3) the Inflation Reduction Act. These pools of investment will provide a ripple effect throughout the economy as funds are spent in the areas of renewable energy, electric vehicles and batteries/charging stations, and semiconductors, as well as ports, highways, grids, and airports. The nation’s annual manufacturing construction outlay will soar to nearly $200 billion this year, up four times from a decade ago.

- Foreign companies have taken note and there has been a major spike of foreign direct investment (FDI) into the U.S. from $150 billion in 2020 to over $350 billion this year, double the FDI flowing into China.

- Artificial intelligence (Generative AI) will have a significant impact across all industry sectors. Banking, high tech, and life sciences are among the industries that could see the biggest impact as a percentage of their revenues from generative AI. Across the banking industry, for example, the technology could deliver value equal to an additional $200 billion to $340 billion annually if the use cases are fully implemented. In retail and consumer packaged goods, the potential impact is also significant at $400 billion to $660 billion a year. It has the potential to change the anatomy of work, augmenting the capabilities of individual workers by automating some of their individual activities – and impact almost every aspect of modern living. For a full analysis by McKinsey of the Generative AI CLICK HERE.

- Inflation is under control and declining rapidly- which is likely to be followed by interest rate reductions in time.

- The decline of the US Dollar results in foreign earnings of the multinationals translating into larger Dollar earnings.

- There is $75 trillion of wealth in the hands of Baby-Boomers: Americans in the age group of 60 – 75 have an estimated $75 trillion that will be spent or bequeathed in the next 15 years. Around ten thousand Americans retire every day and by 2030 all will have reached retirement age. This additional spending power will likely offset the impact of student loan payments by a large margin.

7 CHARTS THAT TELL THE STORY

A PICTURE TELLS A THOUSAND WORDS AND A CHART TELLS A THOUSAND PICTURES:

1. THE COMING MANUFACTURING RENAISSANCE

2. HOUSING COSTS ARE IN DECLINE

The Consumer Price Index includes over 40% to housing so this is a critical component.

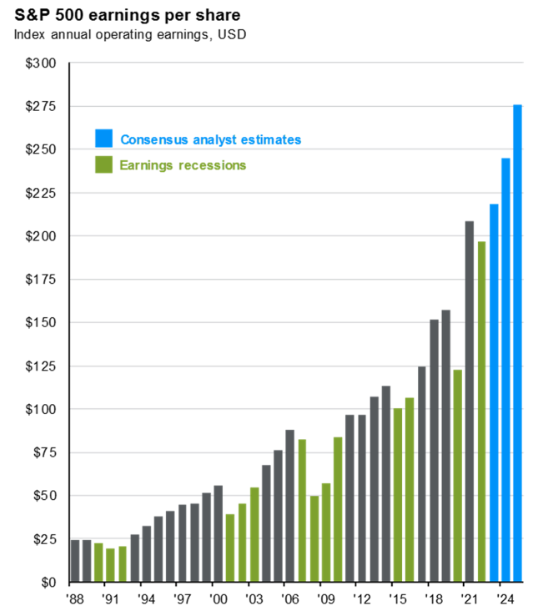

3. CORPORATE EARNINGS ARE EXPECTED TO GROW AFTER A BRIEF DECLINE

This is a key engine that drives equity returns and economic prosperity.

4. CONSUMERS ARE NOT HIGHLY LEVERAGED AND DEBT SERVICE IS AFFORDABLE

Many homeowners have long-term low-cost home mortgages in place. Savings have largely been depleted but debt service is still relatively low. A decline in spending is expected.

5. THE LABOR MARKET IS STRONG

Jobs are plentiful and wages have risen ahead of inflation.

6. INFLATION HAS DROPPED BY TWO-THIRDS

Note the large allocation to housing which is already in decline (see above) and the shrinkage of energy costs.

7. AN ALTERNATE COMPUTATION OF INFLATION

Many believe that the current methodology significantly overstates the Consumer Price Index. CLICK HERE to learn more about an alternative methodology to calculate true inflation and the flaws inherent in the CPI computation methodology.

AT RVW, WE DON’T PREDICT—WE PREPARE

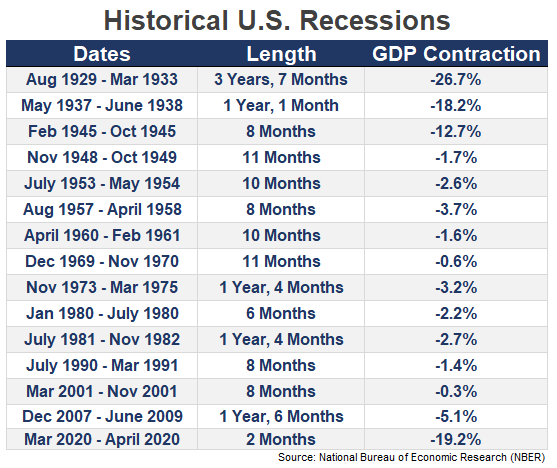

THE HISTORY OF RECESSIONS AND WHY NOT TO FEAR THEM

Who would have expected the 2010s would be the first decade in modern economic history without a single recession after that? Maybe one of the simplest reasons we haven’t had another recession yet is they’re relatively rare.

Here is a list of every recession going back to the Great Depression:

The U.S. economy has been in a recession for a total of 188 months since the summer of 1929. That means we’ve been in a recession roughly 16% of the time over the past 90+ years. Alternatively, this means 84% of the time the economy is not in a recession and is thus in an expansion.

Every recession has ended in recovery, and every bear market has been followed by the resurgence of the bull – as the market has continued its ever-upward trajectory, with many speed bumps on the way up.

ACTIVE MANAGERS (STOCK PICKING & MARKET TIMING) UNDERPERFORM

LEARNING TO UNDERSTAND THE LANGUAGE OF THE DOOM-AND-GLOOMERS: ALWAYS BAD NEWS

The glass is always half-empty for the PermaBears.

Oil prices: When they’re rising, it’s bad because it hurts consumer spending and it drives inflation higher. When they’re falling, it’s bad because they must be a sign of weakening demand, which means we could soon learn the economy went into recession.

Oil prices: When they’re rising, it’s bad because it hurts consumer spending and it drives inflation higher. When they’re falling, it’s bad because they must be a sign of weakening demand, which means we could soon learn the economy went into recession.

Home prices: When they’re up, it’s bad because it means fewer people can afford to buy. When they’re down, it’s bad because existing homeowners are seeing their net worth shrink.

Home prices: When they’re up, it’s bad because it means fewer people can afford to buy. When they’re down, it’s bad because existing homeowners are seeing their net worth shrink.

Walmart sales: When Walmart’s sales disappoint, it’s a bad sign since they are an economic bellwether as the world’s largest retailer. When Walmart sales boom, it’s a bad sign for the economy because it must reflect financially stretched consumers trading down from higher-priced retail options.

Walmart sales: When Walmart’s sales disappoint, it’s a bad sign since they are an economic bellwether as the world’s largest retailer. When Walmart sales boom, it’s a bad sign for the economy because it must reflect financially stretched consumers trading down from higher-priced retail options.

Lending activity. When businesses and consumers borrow more, it’s bad because the leverage they’re taking on puts them at greater risk of financial distress. When they borrow less, it’s bad because they aren’t taking advantage of leverage to amplify their returns on capital.

Lending activity. When businesses and consumers borrow more, it’s bad because the leverage they’re taking on puts them at greater risk of financial distress. When they borrow less, it’s bad because they aren’t taking advantage of leverage to amplify their returns on capital.

-

Short-term interest rates: When they’re rising, it’s bad because it reflects worries about higher inflation and tighter Fed monetary policy. When they’re falling, it’s bad because it suggests slowing economic activity.

Short-term interest rates: When they’re rising, it’s bad because it reflects worries about higher inflation and tighter Fed monetary policy. When they’re falling, it’s bad because it suggests slowing economic activity.

Long-term rates: When they’re rising, it’s bad because borrowing costs are increasing and the discount rate used to value assets is higher. When they’re falling, it’s bad because — similar to falling short-term rates — it suggests slowing economic activity.

Long-term rates: When they’re rising, it’s bad because borrowing costs are increasing and the discount rate used to value assets is higher. When they’re falling, it’s bad because — similar to falling short-term rates — it suggests slowing economic activity.

Market volatility. High volatility is bad because it reflects elevated uncertainty, and “markets hate uncertainty.” Low volatility is bad because it must reflect complacency in financial markets, leaving them vulnerable to a major selloff when bad news breaks.

Market volatility. High volatility is bad because it reflects elevated uncertainty, and “markets hate uncertainty.” Low volatility is bad because it must reflect complacency in financial markets, leaving them vulnerable to a major selloff when bad news breaks.

Consumer spending: When it’s falling, it’s bad because consumer spending is the dominant driver of GDP so it must mean recession risks are rising. When it’s rising, it’s bad because it’s inflationary and may lead to unfriendly actions from policymakers.

Consumer spending: When it’s falling, it’s bad because consumer spending is the dominant driver of GDP so it must mean recession risks are rising. When it’s rising, it’s bad because it’s inflationary and may lead to unfriendly actions from policymakers.

Debt ceiling: Not raising it is bad because we’d get catastrophe in financial markets if it’s breached. Raising it is bad because it gives the green light for the Treasury to sell a ton of bonds, which could drain liquidity.

Debt ceiling: Not raising it is bad because we’d get catastrophe in financial markets if it’s breached. Raising it is bad because it gives the green light for the Treasury to sell a ton of bonds, which could drain liquidity.

Thank you for entrusting your nest-egg to our stewardship and to those who referred friends and family members to us—we are deeply grateful.

Please contact us if there is any change in your personal or financial situation. As trained Personal Financial Planners, our team stands ready to provide guidance and counsel in all related matters.

Sincerely,

Your RVW Wealth Team:

Selwyn Gerber, Jonathan Gerber, Loren Gesas, Mary Ann Moe, Simon Liu, Lisa Blackledge, Jesse Picunko, Dylan Scott, Teresa Green, Simmons Allen, Morgan Vickers, Kelly Sueoka, Shuey Wyne, Erik Stevens, Drew Wallis, Joseph Woods, and Kelly Richardson.

FOR IMPORTANT CURRENT COMPLIANCE AND DISCLOSURE INFORMATION GO TO http://www.rvwwealth.com/

NOTE: The information provided above is not complete, may be erroneous, and omits important data. The charts are estimates and may contain inaccuracies or distortions.

Read and rely exclusively on actual offering documents and on statements received directly from your custodian. The information prepared by us is to highlight aspects of your investments but is incomplete. No decision should be made, or action taken based on it. Investments are not guaranteed and may lose value. Past performance is not indicative of likely future returns.