Medicare is the federal government’s health insurance system for U.S. citizens or permanent residents 65 and up, as well as some disabled people of any age. Most Americans will sign up for Medicare at some point and many have a few misconceptions about it.

My webinar, The Five Biggest Medicare Mistakes, points out these misconceptions and describes how Medicare really works. If you missed it, or any of the Medicare webinars in this series, you can watch them here.

The ABC’s (and D’s) of Medicare

The Five Biggest Medicare Mistakes

First, Medicare is not one-size-fits-all — there are options. It’s also not a set it and forget it program. You will have to check it (at least yearly) to be sure you’re getting the biggest bang for your buck. Also, there are both government and private plans, so it’s wise to do your research. Here are the five biggest Medicare mistakes.

- Categorize your goals into Short term, Medium Term and Long Term to make them more manageable.

- Quantify those goals, both in terms of amount and deadline.

Mistake #1: Thinking Medicare is inexpensive or free

- Medicare does not cover 100% of your healthcare costs.

- Parts A, B, C, D, and Supplement (Medigap) all have costs.

- Some have monthly premiums and deductibles.

- Most have copays or coinsurance.

- Some Medicare plans exclude some healthcare costs.

- Private plans are supplements to government plans; not alternatives to them.

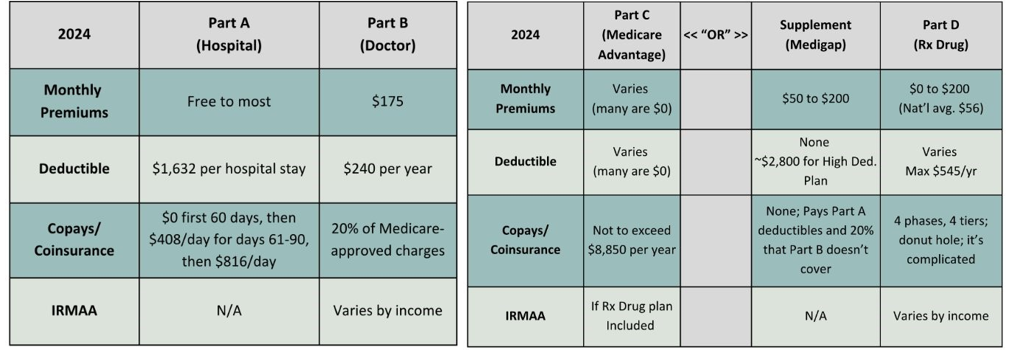

These tables will give you an idea of the (2024) prices of both the government and private plans.

Government Plans Private Plans

What is IRMAA?

If you have questions on these topics or anything else, please reach out to your RVW Team – we are here to support you with all your financial questions and ensure your goals are within reach.

IRMAA stands for income-related monthly adjustment amount.

- The Social Security Administration bases your IRMAA surcharge (if any) on your yearly income from two years ago.

- They add this surcharge to your monthly Medicare Part B and Part D premiums.

- You can appeal the surcharge if there’s an error or you’ve experienced a life changing event that reduced your income.

- Many financial advisors, including Sensible Financial, include resources in their clients’ financial plans that cover retiree health care and IRMAA.

Mistake #2: Enrolling in Medicare late

Enrolling late in Medicare incurs penalties that result in higher premiums — for life. The later you enroll, the heavier the penalties.

- There are different enrollment periods, depending on your situation.

- It is important that you know which period applies to you, so you don’t enroll late.

- Late penalties apply mostly to Parts B and D. If you also pay premiums for Part A (most people don’t), you will also pay late penalties for Part A.

- Medicare Supplement (Medigap) does not have penalties for late enrollment.

Initial Enrollment Period (IEP)

Pertains to those turning 65 and those who:

- Have no health insurance

- Are enrolled in Obamacare (ACA) until 65

- Must leave their employer plan because their company employs fewer than 20 employees

IEP is 7 months long. It covers:

- 3 months before the month you turn 65

- The month you turn 65

- 3 months after the month you turn 65

If you enroll outside of this timeframe, you are LATE. You will pay late penalties on your monthly Part B and Part D premiums for the rest of your life.

If you can remain in an employer plan (yours or your spouse’s/partner’s), you can postpone signing up for Medicare without incurring late fees. However, you can enroll in Part A (Hospital coverage) at 65.

- It’s free (for most), so why not!

- It is secondary to your employer plan’s hospital coverage.

- Don’t enroll in Part A if you are contributing to a health savings account (HSA).

Special Enrollment Period (SEP)

The SEP is based on life events and is not age-specific like the IEP.

When does someone 65 or older qualify for SEP? When they are:

- Retiring and leaving their employer plan.

- On a spouse’s employer plan, and spouse is retiring.

- Working overseas with private or national health insurance, retiring, and returning to the U.S.

You can enroll in Medicare up to 8 months after you leave your (or your spouse’s/partner’s) employer plan. SEP is also available to same-sex marriages, opposite-sex domestic partnerships in states that recognize them, and people under 65 with a disability.

- If you try to enroll after the 8 months, you’re LATE!

Medicare will add late penalties to your monthly Part B and Part D premiums for the rest of your life

General Enrollment Period (GEP)

If you missed the IEP or SEP deadlines, enroll during the GEP.

- GEP is January 1 to March 31 each year.

- Coverage begins July 1.

- You will be uninsured until July 1.

- You will incur late penalties on your Part B and Part D premiums for the rest of your life.

What are the penalties?

Part A: Signing up late for Part A will cost you a fine of up to ten percent of your premium for twice as long as you were late. If you sign up six months late for Part A, you’ll pay the fee on top of your premium for one year.

Part B: You will pay an additional ten percent of your Part B premium for every year you were late in signing up plus the premium itself for life.

- Example: You signed up two years late for Part B coverage.

- Standard Part B premium: $174.70

- Two years late at 10% each year = 20% or $34.94

- $174.70 + $34.94 = $209.64

Your premium will be $209.64 per month for the rest of your life. That means if you signed up at age 67 (2 years after you were eligible), and lived to be 100, you’d be paying an extra $13,836.24!

Part D: If you sign up late for Part D drug coverage, you’ll pay a one percent penalty of the national average premium (Medicare calculates this each year) for each month you are late. If you signed up two years late, that’s an additional 24% on top of your regular premium!

The bottom line is, it’s wise to investigate these enrollment periods ahead of time to avoid paying these penalties.

Mistake #3: Not signing up for a prescription drug plan

You may think, “Why should I pay for a prescription drug plan if I don’t take prescription drugs?” Things change, unfortunately, and you might need to take them in the future.

- Without prescription drug insurance, you could be paying a great deal for medicine.

- If you wait to sign up until you need coverage, you must wait until the next open enrollment period and pay late penalties for life.

- All Rx drug plans have a catastrophic coverage provision, an out-of-pocket threshold above which you have no copays or coinsurance. Even an inexpensive drug plan is better than none.

Mistake #3A: Enrolling in the same prescription drug plan as your spouse just because your spouse is enrolled in that plan.

Don’t do that! Unless the plan adequately addresses your own health needs, too.

How do prescription drug plans work?

While it varies by plan, drug tier, and the health of the covered person, this table illustrates the phases in drug plans.

| Tier | Tier Name | Tier Description |

| Tier 1 | Preferred generics | Least expensive, often generic |

| Tier 2 | Generics | Higher-priced generics and lower-priced brand names |

| Tier 3 | Preferred brands | Higher-priced brand names |

| Tier 4 | Non-preferred | Highest-priced/specialty drugs |

- Pricing tiers are used only during Phase 2, the initial coverage phase, after the deductible (if there is one) has been met.

- Some drug plans have fewer or more tiers than shown above. It depends on the plan.

Mistake #4: Failing to review your private coverage annually

When you enroll in a private Medicare plan, you will receive an Annual Notice of Change (ANOC) every September. It is critical to review this document each year to be aware of any changes to your plan.

Medigap plans:

- Change their rates each year, not their benefits.

Part D (Rx drug) plans:

- Change premiums, deductibles, and copays/coinsurance each year.

- Change drug formularies each year.

- Often change preferred pharmacies each year, affecting costs.

Medicare Advantage plans:

- Often change premiums, deductibles, and copays each year.

- Change their list of doctors, hospitals, and pharmacies each year.

- Change their drug formularies each year (if the plan includes Rx drug coverage).

Mistake #5: Assuming pre-existing conditions don’t matter

- Pre-existing conditions don’t matter when you first enroll in Medicare.

- When you first enroll in Medicare Part B, you have six months to enroll in a Medigap plan, or switch plans, with “no questions asked”.

- This initial six-month period is called the Guaranteed Issue (GI) period.

- It occurs only once for most people; it is not annual.

Exceptions where you may be eligible for GI more than once:

- If you are under 65 and enrolled in Medicare due to a disability, you will be eligible for another GI period when you turn 65.

- You disenrolled from Medicare in favor of employer coverage, and then retired and picked up Medicare again.

- Your Medigap insurance company goes out of business.

- In some states, the GI period occurs yearly. You can change plans any year during the Annual Enrollment Period (Oct. 15 – Dec. 7), no questions asked.

- In those states where the six-month GI period does apply, you may be required to undergo medical review to change Medigap plans after it expires. You may have to pay higher premiums for a plan with more benefits, or you may be denied coverage in that plan.

Be prepared to have medical records reviewed and to be interviewed by phone:

- Know what is in your medical records.

- Answer only what is asked of you; nothing more.

To avoid the possibility of medical review, your first Medigap plan should be the best one (for you) that you can afford. Don’t try to “do it on the cheap”.

You may be eligible for additional GI periods if you have Medicare Advantage instead of a Medicare Supplement (Medigap) plan.

Common scenarios in which you can switch after the GI period has expired include:

- Your Medicare Advantage plan stops offering coverage in your area.

- You move out of your plan’s service area and lose your coverage.

- If you enroll in a Medicare Advantage plan for the first time, you have 12 months to switch to a Medigap plan if you don’t like it, no questions asked. (This is a one-time opportunity.)

Key Takeaways

- Your financial plan should incorporate realistic Medicare costs throughout life.

- Understand the various enrollment periods so you don’t enroll or make changes late.

- Understand the costs of private plans so you choose the right one for you.

- Review your private plans annually for changes that might be costly.

- Choose the best plan you can afford. You might not be able to upgrade later.