Stocks notched solid gains in the first quarter despite some recent setbacks, as enthusiasm about artificial intelligence, signs of a soft landing, the onshoring megatrend and dovish talk from the Fed buoyed investor confidence. The market rally has broadened over the past few months, moving from a story of a few stocks driving the major averages higher to investors investing into sectors sensitive to economic shifts.

Even in the face of tragic and deadly wars in Gaza and Ukraine, escalating tensions between major global powers, the further weaponization of investment restrictions, and the unsettling news of three major advanced economies slipping into recession (Germany, Japan, and the United Kingdom), the US bull market remained intact and broadened. It was powered by the rise of artificial intelligence and an economy that stayed stronger than nearly all of Wall Street had anticipated. The recession that investors had largely agreed was imminent has not yet materialized although headwinds are aplenty and risks to the economy remain ever-present.

The stellar first quarter of 2024 reminded us that US stocks can thrive amidst considerable uncertainty.

Consumer prices rose 3.5% in March compared to a year ago, accelerating markedly from the previous month and reversing some of the progress achieved in a two-year fight to cool inflation. Price increases have cooled dramatically from a peak of about 9%, but inflation still stands more than a percentage point higher than the Federal Reserve’s target rate of 2%.

A spike in housing and gasoline prices at the outset of this year has helped prolong the nation’s bout of elevated inflation. Core inflation — a closely watched measure that strips out volatile food and energy prices — increased 3.8% over the year ending in March, holding steady from the previous month, the data showed. More than half of the monthly increase in consumer prices owed to an uptick in gasoline and housing costs.

Employers hired 303,000 workers last month, blowing past economist expectations of 214,000 jobs added. The hiring far surpassed the average number of jobs added each month over the previous year, suggesting an acceleration in performance for one of the key metrics used to assess the nation’s economic health, and economic performance has been robust.

Here’s what’s in this RVW Report:

• The Charts

• Nvidia under a Microscope

• Market Volatility Unmasked

• Beware of Market Forecasts from the Experts

• The Megatrend Unfolding: Deglobalization & Onshoring

• 5 Lessons for Successful Investing

• Presidential Elections & the Stock Market

• Paying Tribute to a Giant—Nobel Laureate Danial Kahneman

• An Operating System for Life by Shane Parish

• Learning to Ignore the Ever-Present Gloom-and-Doomers

“Growth is strong,” Powell said at a recent conference in San Francisco. “There is no reason to think the economy is in a recession or is at the edge of one. I think we’ve gotten to what is, knock on wood, a pretty good place.”

A PICTURE TELLS A THOUSAND WORDS – AND A CHART TELLS THE STORY

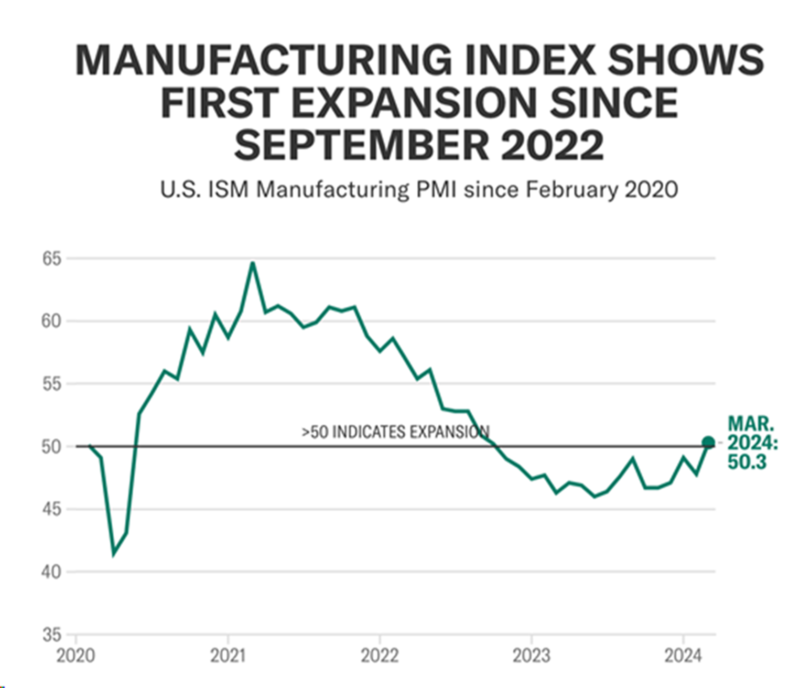

Inflation is moderating but still stubbornly above target.

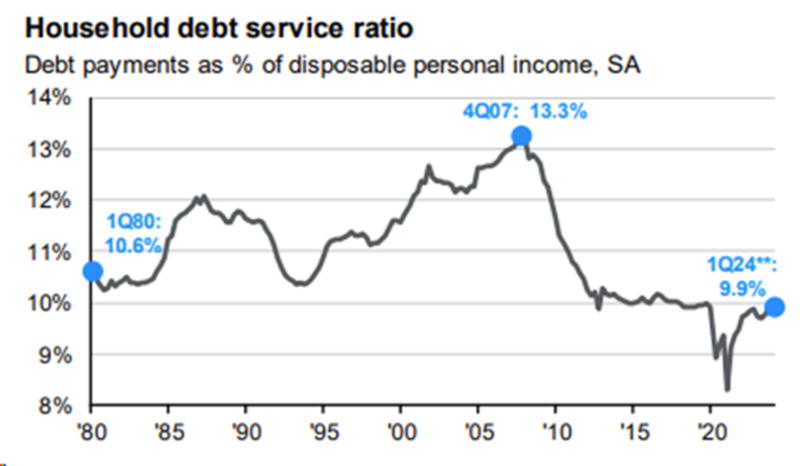

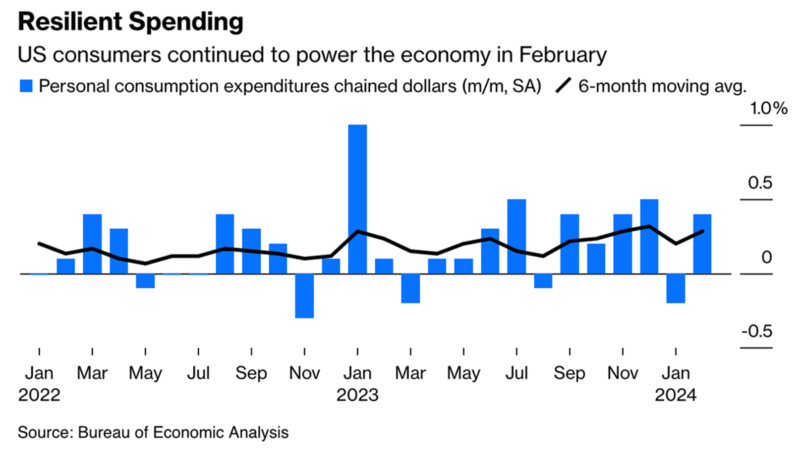

Consumers are not heavily leveraged and are continuing to spend.

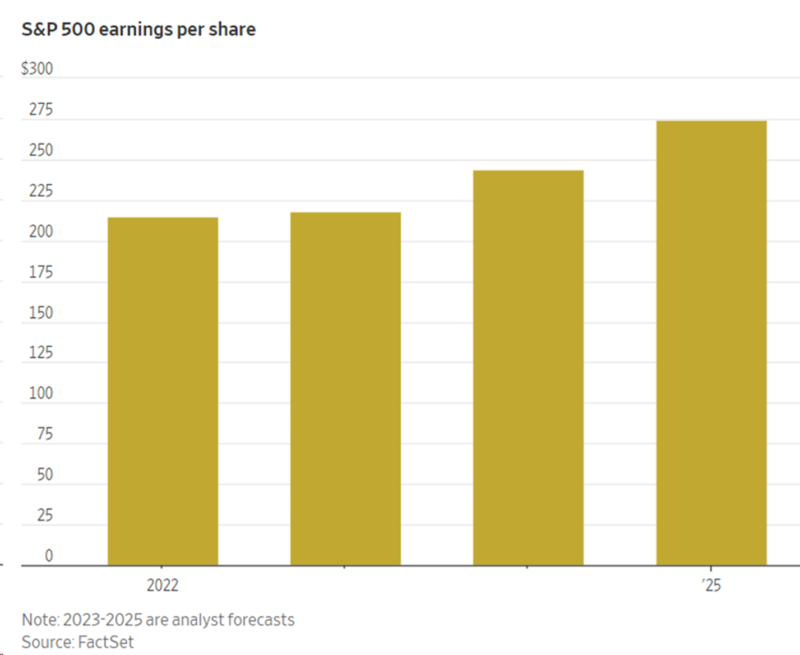

Corporate profits are strong and expected to grow.

HOW THE MIGHTY HATH FALLEN:

“Trees don’t grow to the sky” – Warren Buffett

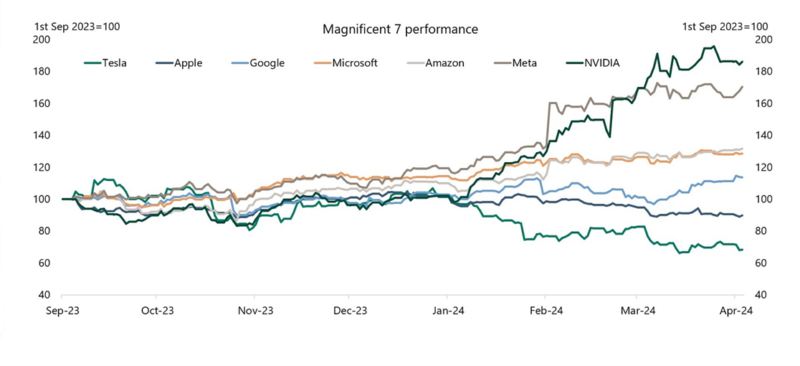

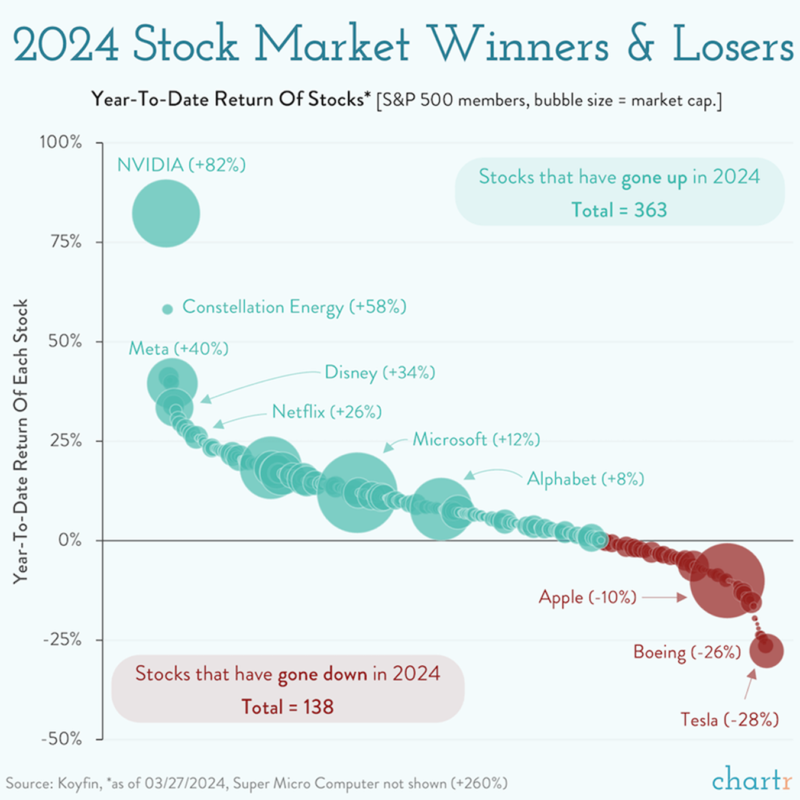

From “Magnificent 7” to “Fabulous 4” to “It’s Complicated”

The profits of the “Magnificent 7” are expected to grow more slowly in 2024 while the rest of the market is seeing faster profit growth.

The perils of stock picking.

NVIDIA UNDER A MICROSCOPE

The big story with Nvidia is that it makes high-powered chips capable of running artificial intelligence (AI) applications. Just about every company that can do so is either directly working on an AI product or explaining to investors how AI will be a direct benefit to it.

Over the past year alone the stock has gained 223%. Over the past three years, the gain is more than 550%. Over the past five years, its gain is more than 1,860%.

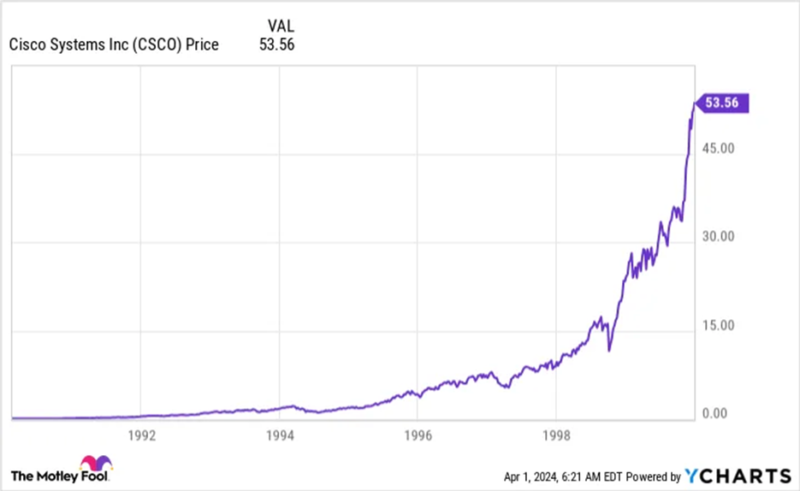

BEN GRAHAM’S DEPRESSION-ERA WISDOM

Benjamin Graham, the man who taught and inspired Warren Buffett pointed out that “even a good company can be a bad investment if you pay too much for it”. An example of that is Cisco Systems (NASDAQ: CSCO). See this chart:

It would be hard not to notice how similar its rocket-like trajectory is to the Nvidia graph above. But the key feature of this graph is actually not the stock price — it’s the dates. The graph ends with the last trading day of 1999. The next graph brings the story up to the present, and it should be more than enough to frighten any investor who is currently all-in on Nvidia.

Simply put, after that Everest-like peak during the dot-com boom there was a dot-com bust, and Cisco’s share price still hasn’t recovered all of the ground it lost. Of course, the same fate may not await Nvidia – and probably does not – but beware of hockey stick charts.

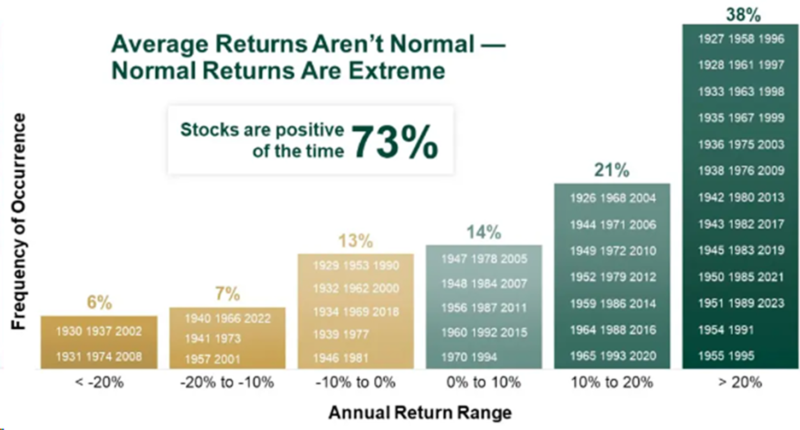

AVERAGE STOCK MARKET RETURNS: AGORAPHOBIA ALERT

The stock market has returned an average of 10% per year over the past 50 years – but hardly ever close to that in any year.

With the market close to all-time highs, don’t develop a fear of heights…. With the stellar return last year and a solid first quarter, it’s natural to feel apprehensive about the sustainability of this bull run.

Here are some reassuring facts. Contrary to popular belief, long-term average returns in the stock market, which hover around 10% annually, aren’t the norm for any given year. Surprisingly, extreme returns, usually on the positive side, are more typical. Markets tend to stray very far from average in any single year.

Volatility, often perceived negatively, is simply movement, whether upward or downward and is the price equity investors have paid for the generous returns they have enjoyed over many years. Despite the day-to-day fluctuations, historical data since 1925 show that stocks rise far more frequently than they fall. In fact, the S&P 500 has recorded gains in approximately 73% of rolling 12-month periods, 88% of rolling five-year periods, and a staggering 94.5% of rolling ten-year periods.

Remarkably, there has never been a rolling 20-year period of negative returns in the entire 98-year span of available data. Moreover, stocks have gained more than 20% in 37 out of 98 calendar years, significantly outnumbering years with substantial losses.

In the past five years alone, we’ve witnessed remarkable volatility, including substantial gains in 2019, 2021, and even amidst the challenges of 2020. These years serve as reminders that significant returns are not as rare as some may believe, and they frequently come when least expected.

HERE’S THE WINNER OF THE “MOST HELPFUL DATA AWARD”:

Goldman Sachs confidently predicts that the market will either go up or down.

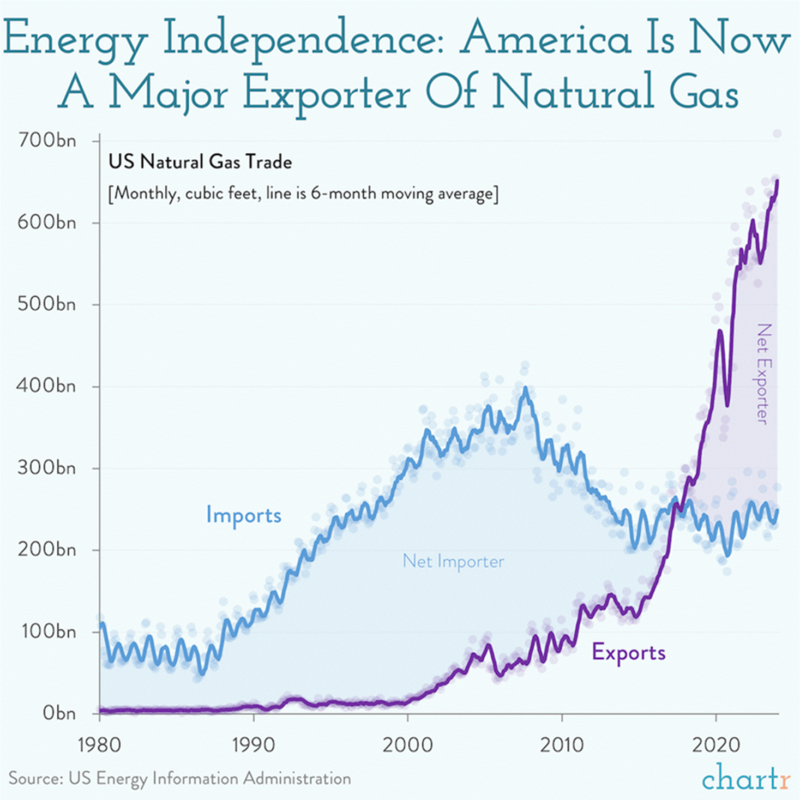

A MEGATREND: US INDUSTRIAL RENAISSANCE—DEGLOBALIZATION IS ACCELERATING

The massive US trade deficit amid accelerating deglobalization provides a powerful investment theme. US infrastructure needs to be modernized and expanded because the US is regaining its economic independence. The market is already rewarding the beneficiaries of this capital reallocation, but it is expected that years, if not decades, of further performance will be driven by this critical societal theme. It is clear that this megatrend will provide a powerful tailwind to the economy.

The reindustrialization of America, the American industrial renaissance, the rebuilding of the American capital stock, reshoring, near-shoring, friend-shoring, or infrastructure are all synonymous names for what might be the most important secular investment theme.

The pandemic revealed the fragility of supply chains in many industries, and geopolitical and governmental issues seem to be multiplying.

Deglobalization is becoming a powerful global economic force, and in order for the US economy to grow through such an environment, it will require tremendous manufacturing and infrastructure investment. US corporations moved operations overseas because they were focused on labor costs, and were ignoring transportation, governmental, geopolitical, and supply chain risks. Global supply chains are shifting and, in most cases, shrinking as everything moves closer to home.

5 LESSONS FOR INVESTING IN UNCERTAIN TIMES FROM MORGAN HOUSEL, WHO IS ONE OF THE MOST IMPORTANT FINANCIAL WRITERS OF OUR TIME

Lesson 1: Future Predictions: A Risky Endeavor

Investors often fall prey to the allure of predicting the future, but Morgan Housel, the author of best sellers “The Psychology of Money” and “Same as Ever,” cautions against this approach. He highlights the case of Bill Clinton’s presidency in 1993 when investors anticipated negative consequences due to expected tax increases. However, the subsequent eight-year bull market proved these predictions wrong, showcasing the folly of relying on political forecasts for investment decisions.

Housel emphasizes that uncertainty and prosperity can coexist. Despite escalating global uncertainties, he recalls Warren Buffet’s reminder post the 2008 financial crisis about enduring constants, such as Snickers being the best-selling chocolate bar in 1962 and in the present day. This underscores the significance of recognizing enduring patterns and behaviors, crucial for sound decision-making in both financial matters and life.

Lesson 2: Prepare for the Unexpected

The COVID-19 pandemic underscored the importance of preparedness over prediction. Housel suggests incorporating low-probability risks into our thinking, as there’s always a chance of unexpected events like recessions, pandemics, or natural disasters. Rather than trying to predict these events, Housel advocates for building portfolios resilient enough to withstand unforeseen challenges. This could involve holding more cash for those inclined towards conservatism, providing a safety net during turbulent times.

Lesson 3: Embrace Volatility as a Fee, Not a Fine

Market volatility often unnerves investors, but Housel reframes it as a necessary component for wealth accumulation. Drawing an analogy to fees versus fines, he likens volatility to a fee required for long-term wealth growth. Acker reinforces this perspective, cautioning against schemes promising high returns with no volatility, a hallmark of potential scams. Volatility, he emphasizes, is inherent to market participation, with enduring it leading to eventual rewards.

Lesson 4: Endurance Over Short-Term Gains]

Investing is likened to a marathon rather than a sprint, especially for long-term financial goals like retirement or education funding. Housel stresses the importance of maintaining a long-term perspective akin to ascending Mount Everest – a challenging yet rewarding journey. Endurance, he asserts, surpasses short-term market gains, with compound interest magnifying returns over extended periods. Despite emotional market fluctuations, Acker advises against succumbing to panic selling, advocating for steadfast adherence to long-term strategies.

Lesson 5: Ask the Right Questions

Housel highlights the significance of framing investment inquiries effectively. Rather than focusing solely on maximizing returns, he suggests questioning sustainability over time. A shift towards sustained average returns over extended periods yields compounding benefits, a principle often overlooked amidst the quest for immediate gains. Acker concurs, emphasizing the role of patience and behavioral discipline in navigating the unpredictability of markets and achieving long-term investment objectives.

In conclusion, while predicting the future remains elusive, prudent investment strategies center on preparedness, resilience, and enduring commitment to long-term goals, underscored by informed decision-making and disciplined behavior.

Here are the 2 key takeaways: 1) it’s difficult to attribute predictably better returns to one party and 2) more meaningfully, it would be foolhardy to think the market can’t make money if the “other” party is in office.

• There is no real correlation between the political party in the White House and stock market returns. No matter how much you may fear the policies of the other party, companies generally still find a way to make profits and produce positive market returns.

• The stock market was consistently and predictably positive from 1926 through 2022, with the only exceptions being a result of the Great Depression, the tech bubble burst and the Great Financial Crisis.

Historical Stock Market Performance During Election Years

| Election Year | Presidential Candidates | Performance During Election Year | Performance For Following Year |

| 2000 | Bush vs. Gore | -9.10% | -11.89% |

| 2004 | Bush vs. Kerry | +10.88% | +4.91% |

| 2008 | Obama vs. McCain | -37.0% | +26.46% |

| 2012 | Obama vs. Romney | +16.0% | +15.06% |

| 2016 | Trump vs. Clinton | +11.96% | +21.83% |

PAYING TRIBUTE TO AN RVW HERO WHO PASSED AWAY RECENTLY: AN HOMAGE TO DANIEL KAHNEMAN

Consider the following riddle: “A bat and a ball together cost $1.10. The bat costs a dollar more than the ball. How much does the ball cost?” Think for a moment but go easy on yourself if your answer was 10 cents. Of course, it is wrong. If the ball was 10 cents the total cost of bat and ball would be $1.20. The correct answer is 5 cents. But the point of the riddle is to underscore that most people had a number in their mind and that number was 10 cents. According to psychologist Daniel Kahneman, who died on March 27 at the age of 90, this example showed how people often make decisions in a hurry, without checking, and are also quite confident about it.

Kahneman was an Israeli-American psychologist who revolutionized the world with his experiments and insights — so much so that even though he was not an economist, he went on to win the Nobel prize in economics in 2002 “for having integrated insights from psychological research into economic science, especially concerning human judgment and decision-making under uncertainty”. Kahneman wrote several seminal books and papers. The most-widely read was titled “Thinking, fast and slow”. The book explained how people think, the errors they make and why, the biases they have and the fallacies that often cloud their decisions. His latest book, “Noise”, focused on the unwanted variability, as opposed to bias, in judgments that should be identical.

Kahneman’s lasting contribution to economics has been to question the dominance of the assumption that all economic agents are “rational”. Through his experiments he underscored the flaws in such assumptions. In doing so, he helped establish behavioral economics as a field and many such as Richard Thaler (winner of the 2017 Nobel prize in economics and most commonly associated with his book “Nudge”) have further advanced the use of such psychological insights in economics. At a macro level, however, even Kahneman knew that society rewards overconfidence. “We want our leaders to be overconfident. If they told us the truth about the uncertainty, we would discard them in favor of other leaders who give an impression that they know what they are doing”.

10 LESSONS OF KAHNEMAN EXPLAINING BEHAVIORAL BIASES OF INVESTORS

(and his often-forgotten colleague Amos Tversky, who left this earth way too early 28 years ago):

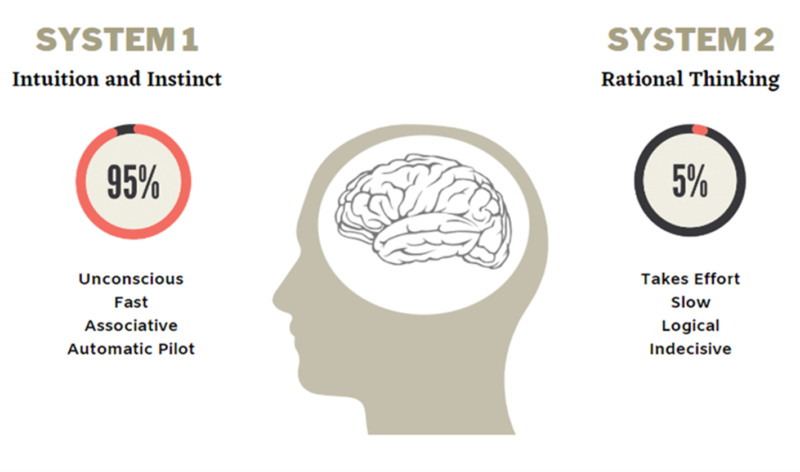

1. System 1 and System 2

We start with the classic. System 1 and System 2 are the terms he popularized to describe the two different ways we think. System 1 is fast and intuitive. We don’t realize it, but it works all the time in the background of our minds.

System 2 is responsible for slow, calculated, and deliberate thinking. It activates when a quick automatic response cannot fix the problem at hand. A typical example is a math task.

Almost all biases and heuristics we will discuss today originate when we are in “System 1 thinking.”

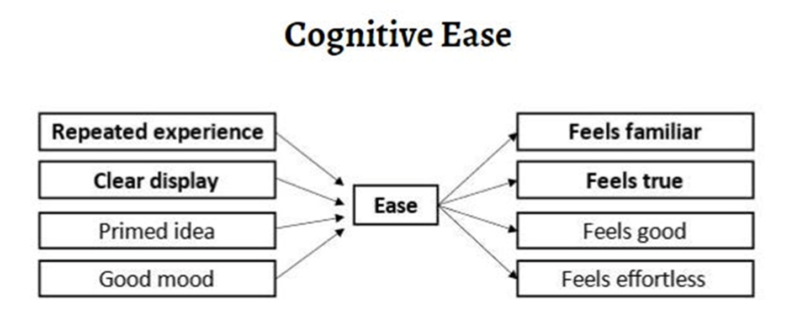

2. Cognitive Ease

Cognitive ease is the main reason all the following biases work so well. It is a desirable state of mind associated with good feelings.

Most of the decisions our fast-thinking System makes are designed to keep us in a state of cognitive ease with as little cognitive dissonance as possible.

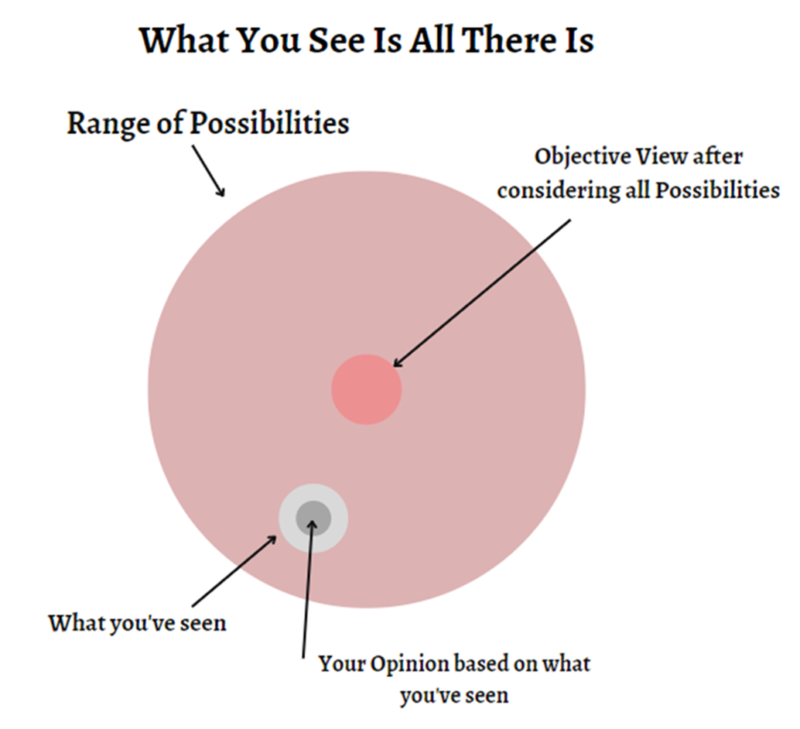

3. What You See Is All There Is

When making a decision, you can only consider what you know. In most cases, the range of all possibilities is much greater than the range of possibilities we can think of. Paradoxically, the less information we have (the smaller our circle of knowledge), the more confident we are in our decisions.

4. Overconfidence

However, on second thought, being overconfident when having less information rather than more is not so paradoxical after all. That’s exactly what cognitive ease is causing. Working with as little information as possible to form conclusions and eliminate the state of doubt and uncertainty.

5. Confirmation Bias

Another bias feeding our desire for certainty and confidence in our decisions is the confirmation bias. It describes how we filter information in a way that fits our existing beliefs.

There are many ways to read the same news, and we interpret it to fit our narrative, mostly unintentionally (System 1).

6. Priming

External factors can also influence how we perceive something. Because System 1 always works even without us noticing it, it is also influenced by things that we do not actively perceive.

Studies have shown the impact of music playing in a store’s background. Customers who bought wine in a store that played French music bought more French wine than customers who visited the same store when it played Italian music (they bought more Italian wine).

The same technique is used in terms of the speed of music. If you want customers to spend more time at your store to potentially buy more products, play slower music. We adapt our walking speed accordingly.

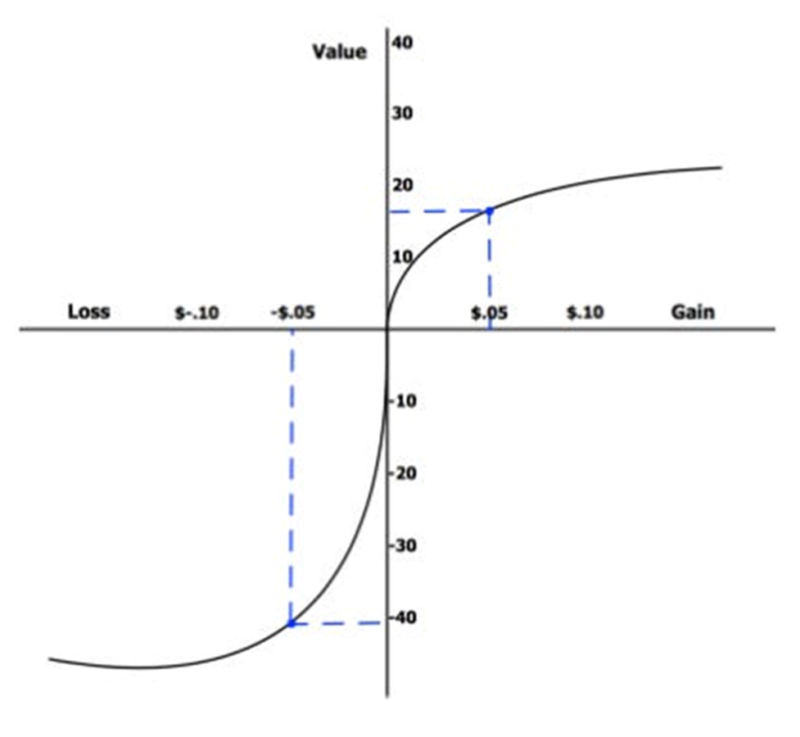

7. Prospect Theory

When making a list of Daniel Kahneman’s greatest lessons, Prospect Theory cannot be left out! It’s the theory that won him the Nobel Memorial Prize in Economic Sciences.

The Prospect Theory has three main takeaways:

1. There’s a preference for a safe win over a gamble with the same expected value.

2. In contrast, we prefer a gamble with a potential higher loss (but the same expected value) over a certain loss.

3. Losses hurt more than equal gains make us happy.

8. Commitment Bias

Commitment is associated with positive characteristics such as consistency and intelligence. Thus, we avoid breaking commitments.

The more public a commitment is, meaning, the more people know about it, the more committed we are to it. You can make this work for and against you depending on how you use this knowledge.

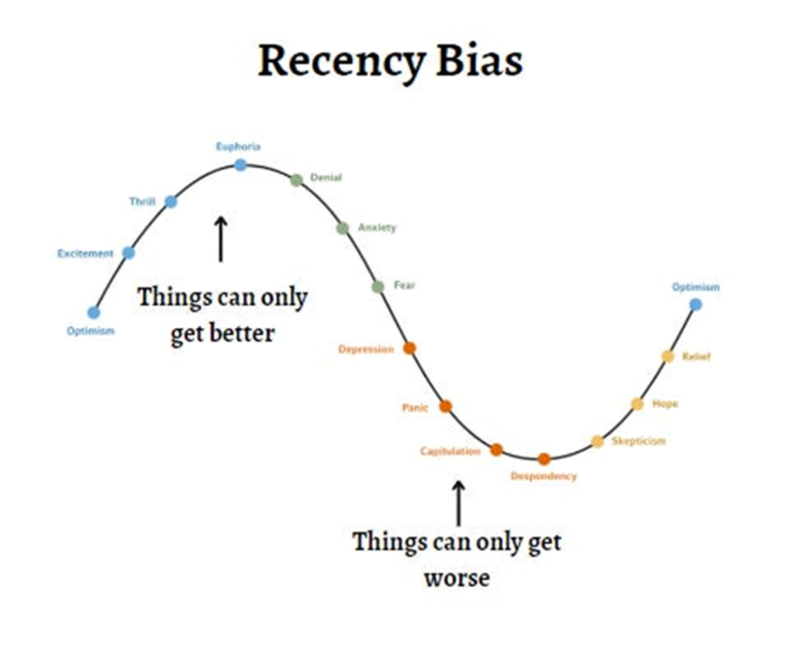

9. Recency Bias

The tendency to overweight recent events and neglect long-term trends or probabilities. This bias also has a big impact on the cyclicality of markets.

When things are great, we think they will get only better.

When things are bad, we think they will get only worse.

10. Endowment Effect

The endowment effect is also partially rooted within the prospect theory. It describes our tendency to value items higher when we own them. It’s linked to the prospect theory via the loss aversion aspect. We do not want to give something up that is already ours, so we value our belongings more.

Another aspect is the justification of our decisions. After spending money on something, we justify that decision by increasing the product’s worth. Of course, this happens unconsciously.

HERE ARE OUR FAVORITE KAHNEMAN QUOTES:

• “The idea that the future is unpredictable is undermined every day by the ease with which the past is explained.”

• “We’re blind to our blindness. We have very little idea of how little we know. We’re not designed to know how little we know.”

• “For some of our most important beliefs, we have no evidence at all, except that people we love and trust hold these beliefs. Considering how little we know, the confidence we have in our beliefs is preposterous – and it is also essential.”

• “The brains of humans and other animals contain a mechanism that is designed to give priority to bad news.”

• “Organizations that take the word of overconfident experts can expect costly consequences … However, optimism is highly valued, socially and in the market; people and firms reward the providers of dangerously misleading information more than they reward truth tellers.”

• “A general limitation of the human mind is its imperfect ability to reconstruct past states of knowledge, or beliefs that have changed. Once you adopt a new view of the world (or of any part of it), you immediately lose much of your ability to recall what you used to believe before your mind changed.”

• “Loss aversion – When directly compared or weighted against each other, losses look larger than gains. This asymmetry between the power of positive and negative expectations or experiences has an evolutionary history. Organisms that treat threats as more urgent than opportunities have a better chance to survive and reproduce.”

• “Neither the quantity nor the quality of the evidence counts for much in subjective confidence. The confidence that individuals have in their beliefs depends mostly on the quality of the story they can tell about what they see, even if they see little. We often fail to allow for the possibility that evidence that should be critical to our judgment is missing—what we see is all there is.”

• “If there is time to reflect, slowing down is likely to be a good idea.”

LifeWisdom: AN OPERATING SYSTEM FOR LIFE BY Shane Parish

“As to methods there may be a million and then some, but principles are few. The man who grasps principles can successfully select his own methods. The man who tries methods, ignoring principles, is sure to have trouble.” — Harrington Emerson

In Principles for Living, Parish lays out an operating system for life. The principles are clear, straight-forward, and help live an effective and meaningful life.

You will find this to be an actionable exercise guiding you to a more meaningful and satisfying life

“All that I write about, think about, and strive to achieve is inspired by one or more of the following principles. I hope they offer some clarity and direction as you carve your own path”.

Click here to learn about 5 life-enriching principles.

FROM THE “GLOOM AND DOOM” DEPARTMENT:

Robert Kiyosaki’s Track Record on Predicting Stock Market Crashes

The “Rich Dad Poor Dad” author has an abysmal record when it comes to stocks.

Beyond his questionable resume, some critics have also blasted Kiyosaki for dangerous and illegal advice he has given during speaking appearances, including advocating for insider stock trading, recommending investors buy stocks on margin in unfunded brokerage accounts and advising people to buy multiple real estate properties with little or no money down.

IMPORTANT: The bespoke allocation of assets in your portfolio, as detailed in the statements you received from your custodian, reflects our mutually agreed-upon design to respond to your needs and goals for safety, growth, and income, respectively. Contact us immediately if this portfolio design does not comport with your current situation or if there have been any changes in your life that have a financial impact. We strongly suggest a Planning & Strategy Meeting with us at least annually either in-person or by Zoom, at your convenience. Please call us to arrange to get together. You should be monitoring your tax situation throughout the year.

As trained Personal Financial Planners, our team stands ready to provide guidance and counsel in all related matters.

Thank you for entrusting your nest egg to our stewardship, and to those who referred friends and family members to us, we are deeply grateful. RVW is about providing a successful investment experience. That means more than just returns. It means providing peace of mind because you know that a transparent process backed by decades of research is powering every decision.

Sincerely,

Your RVW Wealth Team:

Selwyn Gerber, Jonathan Gerber, Loren Gesas, Mary Ann Moe, Simon Liu, Lisa Blackledge, Jesse Picunko, Dylan Scott, Teresa Green, Simmons Allen, Morgan Vickers, Kelly Sueoka, Shuey Wyne, Drew Wallis, Joseph Woods, Arianne Neumark, Doug LaCombe, Dan Villanueva and Kelly Richardson

FOR IMPORTANT CURRENT COMPLIANCE AND DISCLOSURE INFORMATION GO TO http://www.rvwwealth.com/compliance

CAUTION: Read carefully and rely exclusively on actual offering documents and on statements received directly from your custodian. This report was prepared by us to highlight select aspects of your investments and the economy but is incomplete and may contain erroneous information. It is generic and may not be applicable to your situation. No decision should be made, or action taken based on it. Advice not provided in writing cannot be relied upon. Investments are not guaranteed and may lose value. Past performance is not indicative of likely future returns.