Dear Friends,

Attached is the RVW Wealth report for the Fourth Quarter of 2020, which reflects how our steady hand at the tiller, observing core principles of broad diversification and overweighting of factors that historically provided higher expected returns has served you well.

Our use of exchange-traded funds, which are low-cost, tax-efficient rules-based vehicles to access equity ownership, avoids the risks inherent in active stock picking and market timing. Note that the returns reflected are almost entirely-free of current income tax. As a point of reference, keep in mind that Warren Buffett’s Berkshire Hathaway appreciated by 2.3% for the past year.

“Buy not on optimism, but on arithmetic.” – Benjamin Graham

While many investors significantly reduced their Equity holdings during the financial collapse in March, we were focused on seeing opportunities for tax-loss harvesting, and for tilting the sails more into the technology arena, which has rapidly become the core infrastructure of every aspect of life. “Work From Home” (WFH) became the norm and our decision to enlarge our exposure was timely and rewarding.

“Although it’s easy to forget sometimes, a share is not a lottery

ticket…

It’s part ownership of a business.” – Peter Lynch

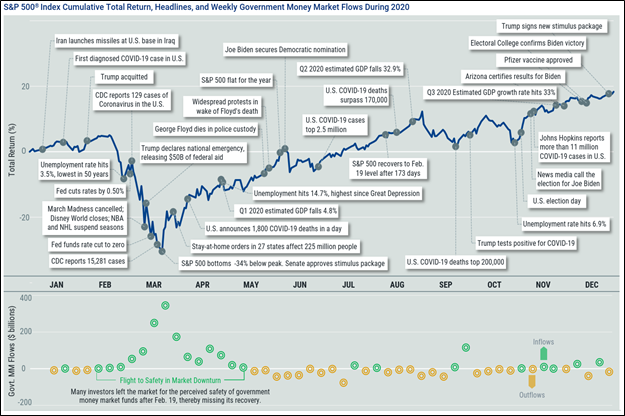

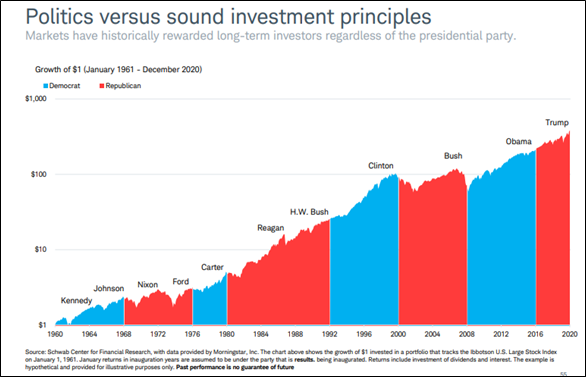

The year 2020 proved to be one of the most tumultuous in modern history, marked by a number of developments that were historically unprecedented. But the year also demonstrated the resilience of people, institutions, and financial markets.

For investors, the year was characterized by sharp swings for stocks. March saw a 33.79% drop in the Standard & Poor’s 500 Index as the pandemic worsened. This was followed by a rally in April, and stocks reached their previous highs by August. Ultimately, despite a sequence of epic events and continued concerns over the pandemic, global stock market returns in 2020 were above their historical norm. The US market finished the year in record territory. Non-US developed markets had a total return of +7.59%, while Emerging Markets delivered double digit returns.

Events of 2020

The Apparent Disconnect

One major theme of the year was the perceived disconnect between markets and the economy. How could the equity markets recover and reach new highs when the economic news remained so bleak? The market’s behavior suggests investors were looking past the short-term impact of the pandemic to assess the expected rebound of business activity and an eventual return to more-normal conditions. Seen through that lens, the rebound in share prices reflected a market that is always looking ahead, incorporating both current news and expectations of the future into stock prices. Our research indicates that only around five percent (5%) of equity pricing is impacted by expectations for the next 12 months, with the lion’s share based on expectations for earnings thereafter.

Reasons for an Optimistic Outlook

The following are key reasons for a bullish view of the future equity markets in 2021:

- The tailwinds of the digital transformation which enhance profitability and efficiency;

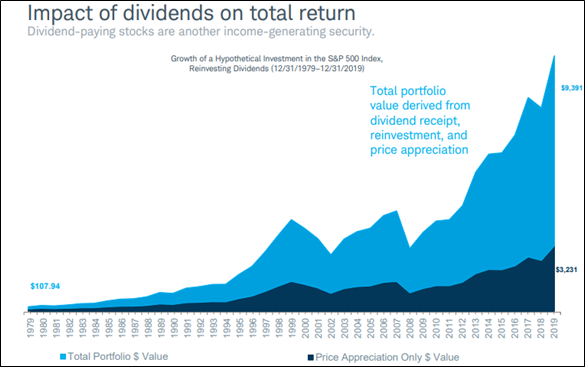

- A low interest rate environment which makes equities a more attractive place to invest, especially in dividend paying stocks;

- Ongoing government injections of funds which in turn stimulate consumer spending;

- Pent-up demand from this recession which translates deferred expenditures into consumption;

- The onshoring back into the USA of manufacturing activity supported by political pressures, robotics and abundant cheap energy.

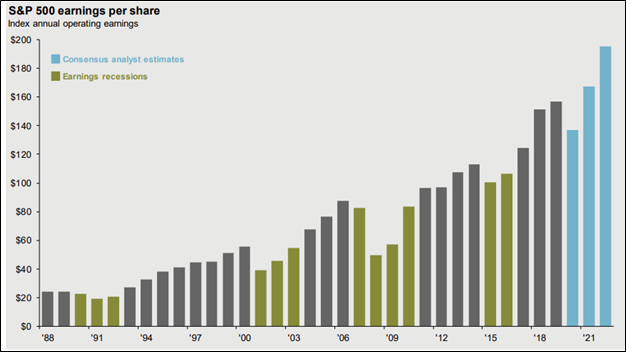

Furthermore, corporate earnings are solid and expected to grow:

Dividend-Paying Stocks are the New Bond Alternatives for those seeking income, especially in an era of low interest rates.

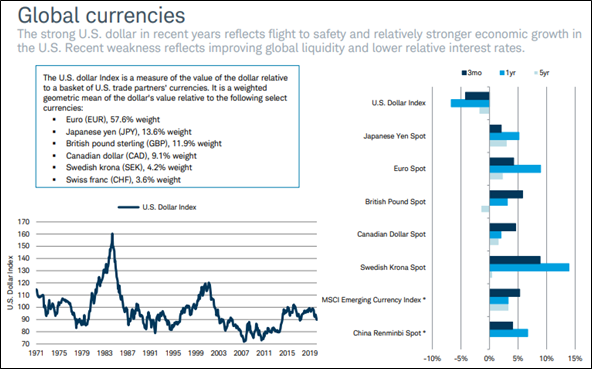

The Declining Value of the Dollar which translates foreign earnings into larger Dollar amounts:

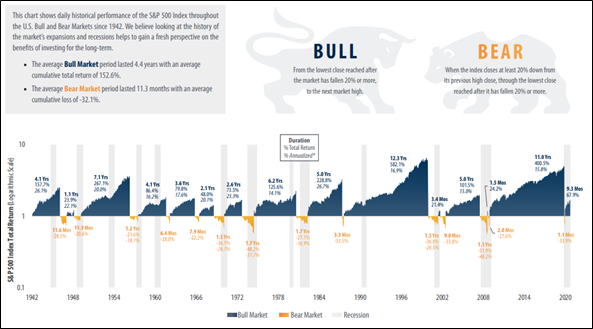

Bull and Bear Markets in Perspective

Looking back, it appears to be a very long bull market with occasional interruptions of decline, which in turn have simply proved to be bumps of varying magnitudes, on the way up:

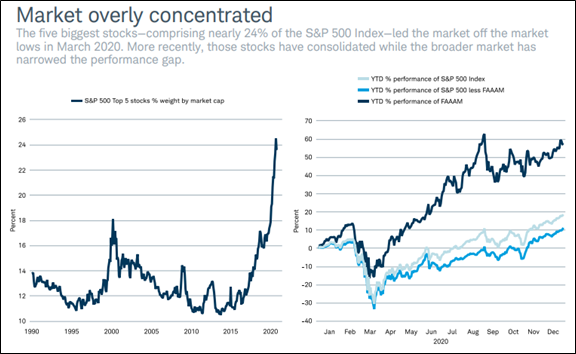

The headlines were focused on just a few big names – which drove most of the returns in the popular indexes: Apple , Microsoft, Amazon, Alphabet, Facebook and Tesla are now collectively worth more than $8.1 trillion, accounting for nearly 25% of the total $33.3 trillion market value of all the companies in the S&P 500:

This Quarter’s Featured Media

Featured Webcast

INVESTING IN THE BIDEN ECONOMY: What Will Change and What Won’t

- The growing importance of impact and sustainable investing

- The 4th Industrial Revolution – integrating tech into every aspect of life

- The economic and political impact of the evolving relationship with China

- What has changed and what won’t

If you missed this extraordinary presentation to RVW clients and friends on Thursday, 1.21.2021, by Jack Manley VP and Chief Global Strategist with JP Morgan, click here to view the replay.

Featured Podcast

The Moderna Story: The Machine that Made the COVID-19 Vaccine

A year ago, none of us would believe that mRNA vaccines would be a household name. And yet here we are, counting the days towards a vaccine that could not just save lives but will help bring us back into a world that feels “normal” again. In this special episode, airing the day the FDA authorized the vaccine for emergency use, Moderna CEO Stephane Bancel tells the story of the machine that made the vaccine: the platform, the technology, and the moves behind the vaccine’s development.

This episode of Bio Eats World takes us from a world of pipette and lab benches to a world of industrial robots making medicines: We used to grow our vaccines, now we can “print” them, getting them to patients faster and more efficiently than ever before.

In a conversation with a16z general partner Jorge Conde and Bio Eats World host Hanne Winarsky, Bancel describes the exact moment he realized they might actually be able to make a vaccine for COVID-19; what happened next to go from pathogen to design; how this new technology that uses mRNA works (in a chocolate mousse metaphor!), and what makes it different from “old” vaccines; and how to think about managing both innovation and speed in this world. Why is this such a fundamental shift in the world of drug development? And where will this technology go next?Click here

Featured Video:

Here’s LifeWisdom from one of the wisest people on the planet.

Featured Book

Powerful WealthWisdom ® FROM MORGAN HOUSEL

Morgan Housel’s recently published best seller The Psychology of Money is a treasure chest of profound insights into this complex subject. We highlight four in particular that may be helpful as we enter the new year:

1. Risk

On the topic of risk, Housel provides a timely warning as well as a counter-intuitive insight. We start with the warning: “You can plan for every risk,” he says, “except the things that are too crazy to cross your mind.” And for that reason, “the most important part of every plan is planning on your plan not going according to plan.” In other words, plan as if another 2020 might happen this year—or in any given year.

How is this accomplished? If you turn to the textbook, there’s definitely a formula for structuring an “optimal” portfolio. That will yield the right answer mathematically, but it may not be the answer that makes the most sense. That’s why Housel recommends putting the math aside.

Instead, he recommends these two steps continuously:

1. Save more than you think you might ever need.

2. Maintain more of your savings in cash than you think you might need. In other words, build in room for error in your financial plan.

These steps might seem unnecessarily conservative. For better or worse, though, we agree that this strategy is a good way to protect yourself from a universe of unknown unknowns.

Housel also provides this insight, which might make you feel better about being conservative: “Room for error,” he says, “is underappreciated and misunderstood. It’s often viewed as a conservative hedge, used by those who don’t want to take much risk…But when used appropriately, it’s quite the opposite.” Why?

Housel explains the twin benefits of maintaining a conservative balance sheet:

- First, and most obviously, it helps you to avoid ruin when the unexpected occurs.

- In addition, it allows you to “remain standing” when there’s a market downturn. By this, he means that you’ll be in a strong position—both financially and emotionally—to be a buyer the next time the market drops like it did last year.

2. History

We are all influenced by our own personal experiences with money. That is no surprise. There is also a generational element to this: It’s well known that people who grew up during the Depression are naturally more conservative. But this phenomenon isn’t limited to children of the Depression. Housel points out that the economic environment during our own formative years affects us all.

Consider, for example, inflation. “If you were born in 1960s America, inflation during your teens and 20s… sent prices up more than threefold. But if you were born in 1990, inflation has been so low for your whole adult life that it’s probably never crossed your mind.” The same applies to each generation’s experience with stock market returns, with interest rates and with unemployment.

As a result, we all have biases—sometimes conscious but usually not—in how we think about money. Of course, there’s nothing you can do to change your own history. What you can do, though, is try to be aware of these unconscious biases. That, in turn, may help you to be as objective as possible in making financial decisions.

3. Role models

Housel points out an interesting paradox: We like learning from other people—but sometimes there isn’t a whole lot to learn. That’s because it’s so difficult to measure the role of luck in any one person’s success or failure. And if you ask someone to explain their own success, they probably won’t attribute much of it to luck. Housel’s view, however, is that there is always an element of luck in anyone’s success.

The lesson: Don’t try too hard to copy from someone else’s financial playbook. For a lot of reasons—including luck—it probably won’t work. Instead, develop an investment strategy that is the best fit for you.

4. Time

The benefits of compound interest are well understood. But usually, this concept is illustrated with uninspiring charts and graphs. Housel takes a different approach, providing living examples, including Warren Buffett, who has been investing longer than most of us have been alive. Buffett bought his first stock when he was just 11. And today he is 90.

The result: “…Warren Buffett’s net worth is $84.5 billion. Of that, $84.2 billion was accumulated after his 50th birthday.” Without taking anything away from Buffett’s intelligence or skill, there’s no question that compounding has worked in his favor. The lesson: If there’s a young person in your life—a child, a grandchild, a niece or nephew—the greatest (financial) gift you can give that person is to help them get started investing. Get a teenager set up with a Roth IRA, and they will be forever grateful.

Featured Complimentary Book

How to Raise Your Child’s Financial IQ by John Lim

From the Author: About four years ago I decided to write a book to my children, passing on everything I knew about finance. I knew nobody else would teach them, and I didn’t want them to have to learn through the school of hard knocks.

The result is this book. Actually, this book is just the first in a series of books that will cover finance and investing, a series I have called How to Raise Your Child’s Financial IQ.

This book is unusual in a few ways. First, it is written for children. When I started researching my book, I was startled at just how few books on finance are written for children. This is a shame because money is something children are naturally curious about.

It is also unfortunate because the sooner you learn about finance, the better off you will be financially. Albert Einstein called compound interest the eighth wonder of the world, and the rocket fuel for compound interest is time, which children and young adults have more of than any of us. The other unusual thing about my book is that it assumes children are capable of learning.

Sincerely, Your RVW Team: Selwyn Gerber, Jonathan Gerber, Ofer Ben-Menahem, Stephen Seo, Loren Gesas, Simon Liu, Jesse Picunko, Mike Chen, Mary Ann Moe, Lisa Blackledge, Kristen Gunn, and Monica Erps