A Steady Hand at the Tiller – Navigating Turbulent Waters

RVW Wealth has just disseminated our reports for the Fourth Quarter of 2021. The results again demonstrate how our evidence-based wealth management approach traversed the choppy waters to deliver solid returns.The narrative that accompanied the quantitative reports is provided below.

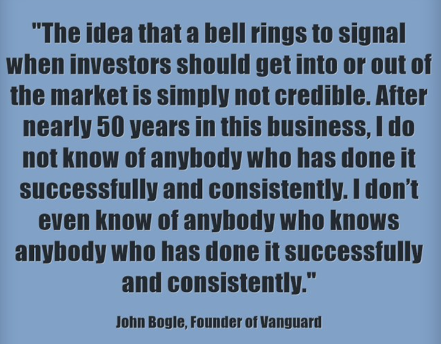

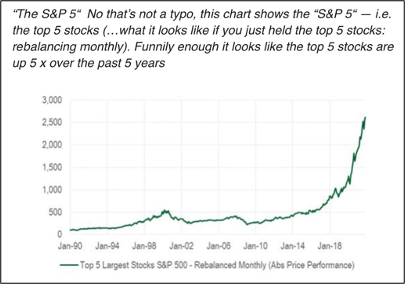

Although several major indexes appreciated significantly, they did so because of heavy concentration in a handful of stellar holdings, while being exposed to concentrated risk. For example, the five biggest holdings in the S&P 500 Index, a commonly used benchmark of the stocks of U.S. Large-Capitalization companies, contributed to the lion’s share of the growth.

Initial public offerings and memes were other darlings of the market, and they ended up showing significant declines as the year ended – a trend that has continued so far this year. Our approach to equity selection views shareholders as being owners of fractional interests in businesses rather than frantically trading pieces of digitalized paper known as share certificates. Therefore, our focus is on selecting the stocks of quality companies with attributes that are generally associated with successful businesses.

Your RVW Wealth Team includes CPAs (Certified Public Accountants) and CFA (Chartered Financial Analyst) Charterholders – data-oriented professionals who eschew headlines and hype. Our broadly-diversified approach owns a broad selection of businesses and sectors that seeks to replace risk with volatility.

The former is the possibility of a permanent loss of capital, while the latter means that market prices are the result of the clash between bulls and bears; between fear and greed – as exhibited by the periodic overvaluation and undervaluation of equities. It has been said that diversification is the only free lunch in investing – and within that, we overweight towards companies with attributes that have historically indicated higher expected returns.

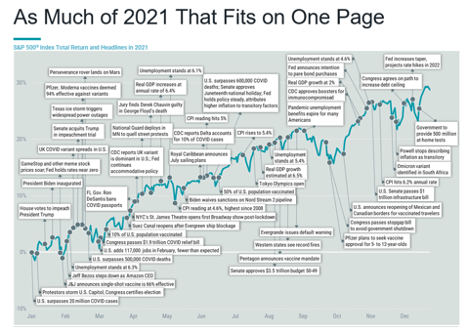

2021 Economic Highlights

Economic activity collapsed in the first and second quarters of 2020, then rebounded in the third quarter. Since that time, we have had strong, but erratic growth. Taken as a whole, the past year had the fastest growth in Gross Domestic Product (GDP) and the highest inflation in many decades.

As a reminder, this is not a normal business cycle – we have never locked down businesses, we have never seen such a rapid peacetime expansion of federal spending, and we have rarely seen such a huge increase in the M2, a measure of money flushed into the economy.

Shutting down the economy destroys supply chains because they work best with a free flow of information and goods. Paying people not to work has significant adverse implications for the economy and society. Small businesses have suffered much more than large companies, but as is evident from the discussion below, many new businesses started up during the pandemic and the entrepreneurial spirit in America is back.

After these dramatic disruptions, and even with the curve balls we keep getting thrown from the virus, the economy has managed to stay on reasonably firm footing as we head into the new year. Compared to the experience of the long 1970s, the inflation we are seeing today is likely to be situational rather than fundamental based on market expectations, although it is likely to take some time for this process to work its way through the economy.

Conditions remain in place to support a generally positive environment for equities, particularly higher-quality companies with solid debt-to-capital ratios and healthy cash flow generation.

A Refreshing Perspective on Money and Happiness

Eighteenth-century Swiss philosopher Jean-Jacques Rousseau said, “The money you have gives you freedom; the money you pursue enslaves you.” He clearly believed that money alone can’t guarantee happiness, and many other philosophers, business moguls, and philanthropists both before and after his time would agree. After all, it’s likely very few of us in the end would take more of the stuff that money can buy in exchange for less of the things that it can’t. This understanding is at the heart of the approach we take to designing your financial life plan.

Sure, we all know that wealth provides a certain level of wellbeing. It’s also true that, after a point, the happiness money offers can be more fleeting. This concept has spurred a welter of socio-psychological and financial studies to determine whether an increase in wealth – beyond satisfying your essential needs – will result in a similar increase in happiness.

Your long-term financial plan is one mechanism to help translate your money into happiness because as we say repeatedly, peace of mind is everything. Your RVW Wealth advisory team works diligently with this idea in mind when helping you select an investment portfolio and implement planning strategies to meet your life goals and desired milestones. In this way we enable you to be mindful of how your financial life plan can deliver freedom, flexibility, and internal peace.

The Data

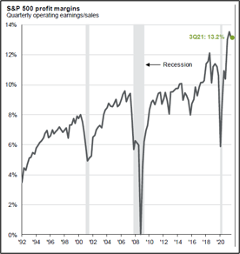

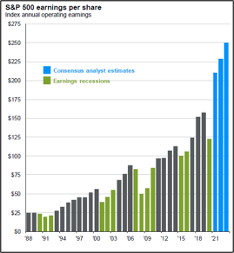

Corporate Earnings are Strong and Profit Margins are High:

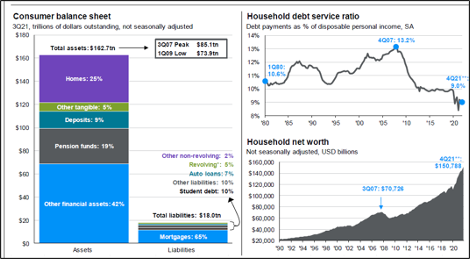

Consumers Are In Fine Financial Shape With Strong Balance Sheets: Debt Servicing Costs Are The Lowest In Over 40 Years As A Percentage Of Income

Inflationary Expectations

Watch these two videos to learn about how in inflation is caused

Watch Brian Wesbury explain inflation in a way you may not have thought about it before. Brian is one of the economists on whom RVW Wealth relies for valued input, focusing on macroeconomics and economic forecasting. He appears on television stations such as CNBC, Fox Business, Fox News, and Bloomberg TV frequently. He is a member of the Academic Advisory Council of the Federal Reserve Bank of Chicago, and has an impressive list of credentials.

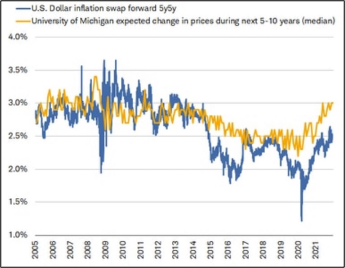

Inflation is Likely to be Situational Rather than Fundamental

Fears about higher and persistent inflation have been well telegraphed by consumers, but some data-driven market measures have adopted a more sanguine tone. As shown in the chart below, the 5-year, 5-year U.S. dollar inflation swap rate—which measures the expected average inflation rate over the five-year period that begins five years from today—has moved lower from its recent high of 2.6%. Another measure, from the University of Michigan, implies that consumers expect inflation to settle at 3% over the same time frame—markedly lower than the current rate of 6.8%.

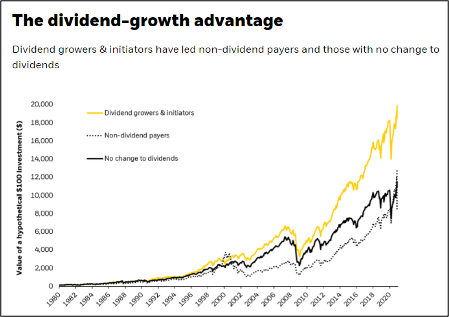

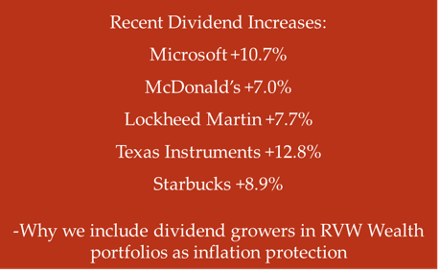

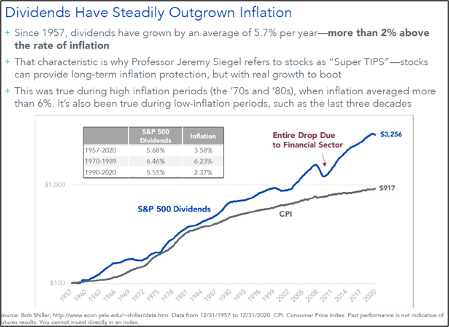

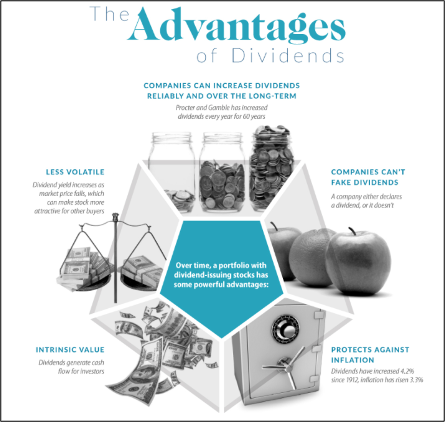

Why We Include Income Dividend-Growing Companies in RVW Wealth Equity Portfolios

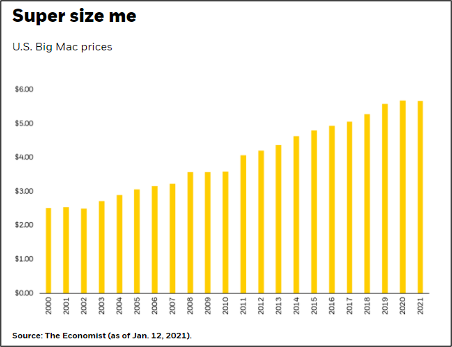

An example of how companies can pass on increased costs to consumers to keep up with inflation:

The Market for Initial Public Offerings of New Listings Started the Year Well and Then Fizzled:

Massive Performance of the Top Five Market Capitalization Stocks in the S&P 500 Index

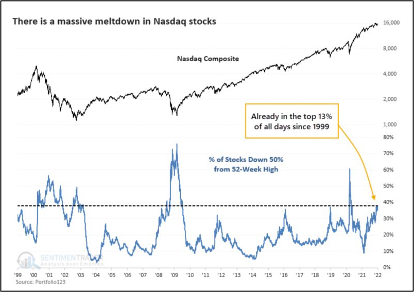

Number of NASDAQ Composite Index Stocks Down 50% or More is Almost at a Record

- 40% of index’s firms have fallen by half from one-year highs.

- Investors are apparently selling first, then figuring out rest later.

- More than 90 large-cap stocks are down at least 20% from their 2021 highs.

A near-record number of technology stocks have plunged by some 50% in an echo of the dot-com crash. Roughly four in every 10 companies on the NASDAQ Composite Index have seen their market values cut in half from their 52-week highs, while the majority of gauge members are mired in bear markets.

Valuations are at historical highs, companies are raising billions based on what looks to some like fairy dust, and the Fed is signaling a tightening cycle – possibly a perfect recipe for further declines. For some examples of companies that have declined significantly from their highs: Twitter – 51%, PayPal – 40%, Etsy – 39%, and Salesforce – 27%.

Startup Boom in The Pandemic is Growing Stronger:

The Flip Side of The ‘Great Resignation’ — A Small-Business Boom

A surge in new business formation suggests that the coronavirus pandemic has created a landscape in which entrepreneurs and startups can thrive and new innovations can break ground. The coronavirus pandemic appears to have unleashed a tidal wave of entrepreneurial activity, breaking the United States out of a decades long startup slump.

Americans filed paperwork to start 4.3 million businesses last year, according to data from the Census Bureau, a 24 percent increase from the year before and by far the most in the decade and a half that the government has kept track. Applications are on a pace to be even higher this year.

The surge is a striking and unexpected turnaround after a 40-year decline in US entrepreneurship. In 1980, 12 percent of employers were new businesses. By 2018, the most recent year for which data is available, that share had fallen to 8 percent. The latest release of Census Bureau’s Business Formation Statistics data shows that nearly 1.4 million applications have been filed to form new businesses likely to hire employees through September of 2021 — the most through the third quarter of any year on record.

The shock of the pandemic appears to have caused significant restructuring of certain industries and a realignment of some relationships between businesses and customers, hastening an end to the startup stagnation that defined the post-Great Recession economy.

This entrepreneurial reaction to the economic shock is a testament to the U.S. economy’s underlying resiliency. Maintaining this high level of new business formation will be crucial in placing the economy on a strong and durable path to its recovery and helping eliminate the startup deficit that had built up in recent years.

FREE E-BOOK

Whether you’re seeking ideas on becoming a better thinker, decision-maker, or just to live in peace and happiness, The Sketchbook of Wisdom has it all.

Packed with ideas from Krishna to Taleb and Socrates to Munger, the book is a hand-written manual on the pursuit of wealth and good life.

To download this gem, click here.

Don’t Set Goals for 2022: Instead, Choose A One-Word Theme

The more New Year’s resolutions you set, the faster you’ll feel like a failure. Many tend to pick multiple new goals each year. Instead of a barrage of targets, try setting one goal, but the real game-changer, however, is using a different concept altogether. That concept is a theme.

A theme is a laid-back, human-proof, considered approach to improvement. Goals are a bad way of trying to achieve happiness. But why? First, goals are a constant source of pressure until you achieve them. They undermine your self-worth. You feel like you “lack” the result of the goal, and until you fix it, your self-esteem will remain in the dumps. Second — and this is even worse — when you do achieve a goal, your sense of fulfillment never lasts. You celebrate for a minute, then move the goal post (pun intended) and set your sights on the next one.

So, what makes a good theme?

First, your theme should be a single word to guide you through the year. It must not be complicated. Otherwise, you won’t naturally remember it right when you need it the most.

Second, the best themes to be words that can act both as verbs and nouns. Here are some examples: Love, Balance, Focus, Act, Share, Grace, Believe, Work, Move, Rest.

https://forge.medium.com/dont-set-goals-for-2022-6f0805c85035

A Final Note Of Caution

Thank you for entrusting your nest-egg to our stewardship. Please contact us if there is any change in your situation that impacts the allocation of your portfolio or any other aspect of your financial life that you wish to have us review with you. As trained Personal Financial Planners, our team stands ready to provide guidance and counsel in all related matters.

Sincerely,

Your RVW Wealth Team: Selwyn Gerber, Jonathan Gerber, Stephen Seo, Loren Gesas, Ofer Ben-Menahem, Mary Ann Moe, Simon Liu, Jesse Picunko, Mike Chen, Dylan Scott, Lisa Blackledge, Monica Erps, Teresa Green, Shelly Moore, Kristen Gunn, Eva Barberi, Anita White, Simmons Allen, Yehoshua Wyne, and Kelly Richardson.

FOR IMPORTANT CURRENT COMPLIANCE AND DISCLOSURE INFORMATION GO TO http://www.rvwwealth.com/compliance

NOTE: The information provided above is not complete, may be erroneous, and omits important data. The charts are estimates and may contain inaccuracies or distortions.

Read and rely exclusively on actual offering documents and on statements received directly from your custodian. Investments are not guaranteed and may lose value. Past performance is not indicative of likely future returns.