In October 2022, Bloomberg Economics predicted the odds of a recession in 2023 at 100% and most Wall Street observers were pessimistic. The Federal Reserve had raised interest rates seven times in 2022 (with plans for further rate hikes) to slow down inflation, and the resulting increase in borrowing costs threatened to stifle business investment and dampen consumer spending.

However, the US economy proved far more resilient than almost anyone expected. Growth in the first three quarters of the year averaged an annualized 3.2%, with a further 1.3% expected for Q4. Inflation weakened and unemployment has remained surprisingly low.

Behind the dramatic turn in attitude is a growing belief among investors that the Federal Reserve’s campaign to fight inflation is winding down, ending the interest-rate hikes that buffeted markets in recent years. Many now expect the central bank will likely next cut rates instead, shifting market dynamics in ways that seemed unlikely just months ago.

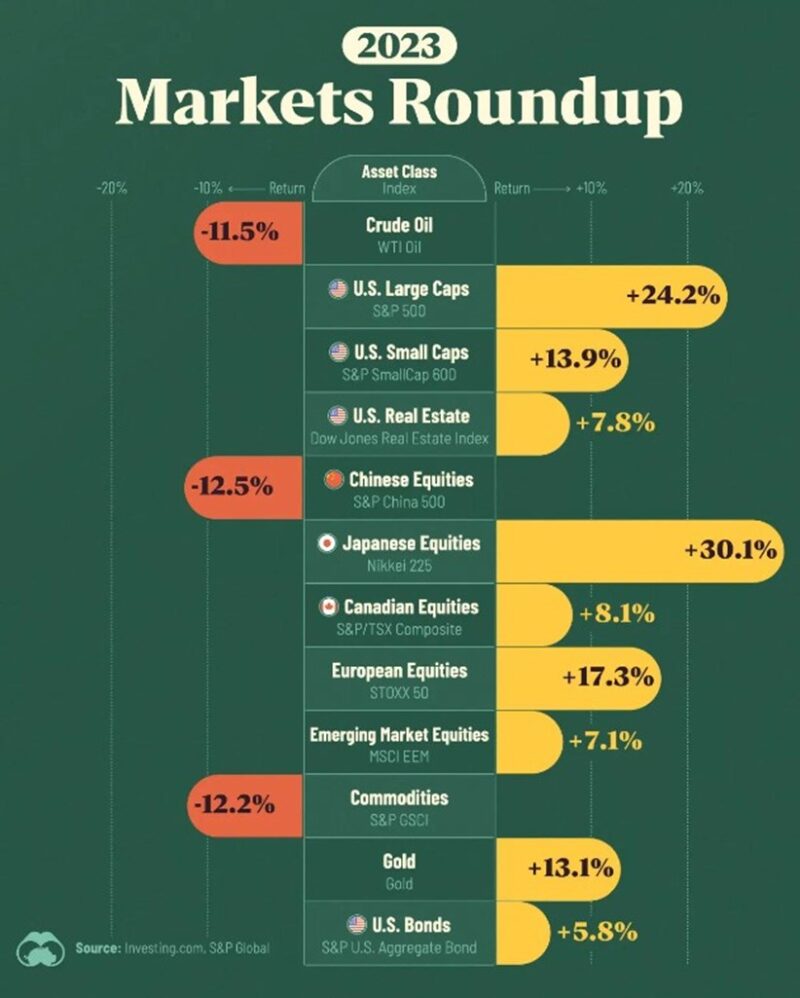

The year culminated with a fierce “everything rally” that pushed prices higher in nearly every asset class, including stocks, bonds, gold and even cryptocurrencies. Yields on risky corporate bonds have fallen to some of the lowest levels of the past year, while bond prices have rallied.

The benchmark 10-year Treasury yield settled at 3.860%, near where it started the year, but down from a peak of 5.021% in October.

RVW pays no attention to economic forecasts and market predictions which tend to be notoriously inaccurate. The sole aim of our equity investments is to own fractional interests in a diverse group of select successful profitable businesses. We do not believe in individual stock selection nor do we time the market. That style of investing has been shown to be sub-optimal. Rather than attempting to predict the future or outguess others, we draw information about expected returns from the market itself— leveraging the collective knowledge of millions.

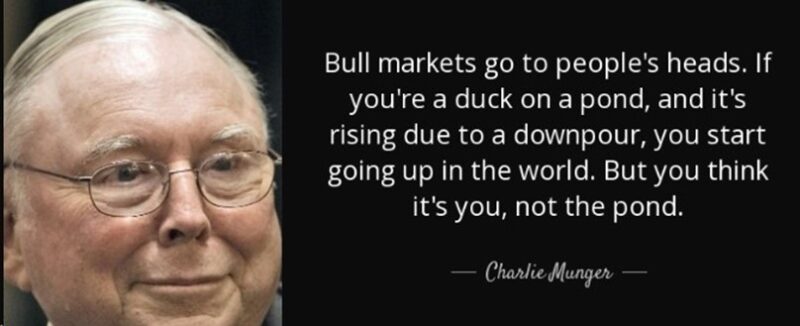

RVW’s investment approach is grounded in economic theory and backed by decades of empirical research. We proudly sit on the shoulders of the giants – one of whom passed away in December and to whom we pay tribute in this Report. Please scroll down to see the coverage we provide on the passing of Charlie Munger whose wisdom and insights help light the path for us every day.

• The international economy displayed remarkable resilience. Since 2020, it has endured a pandemic, war in Europe, and supply chain chaos, which together triggered the highest inflation and most aggressive interest rate-raising cycle in decades. Yet, economies have adapted better than expected, and that continued in 2023. In the third quarter the world’s gross domestic product was more than 9% larger than pre-pandemic levels, according to Fitch Ratings’ global aggregate. Businesses rewired their logistics, Europe weaned itself further off Russian gas, and higher rates did not lead to a spike in unemployment. Such durability provides a strong foundation for the new year.

• Inflationary forces are fading rapidly. Global price growth ended 2022 at 8.7%, falling to 6.9% in 2023, and is forecast to decline further in 2024. Food price inflation — from wheat to cooking oils — has declined, and the surge in energy prices is unwinding. The concatenation of pandemic-era supply chain shocks has also eased. Services inflation remains sticky, but that is a result of strong job markets and rapid wage growth. Housing cost inflation remains elevated but based on a lagged computation—recent data indicate rents have plateaued and may be falling.

• Fear of interest rates staying “higher for longer” is fading. The major central banks may now cut rates earlier in 2024 than anticipated. Although three regional US banks and Credit Suisse foundered in March, the fallout from higher rates has been contained.

• Wall Street’s leading indices surged this year implying that the chance of a soft landing for the US economy in 2024 — where the Fed gets inflation under control without causing a recession — has risen.

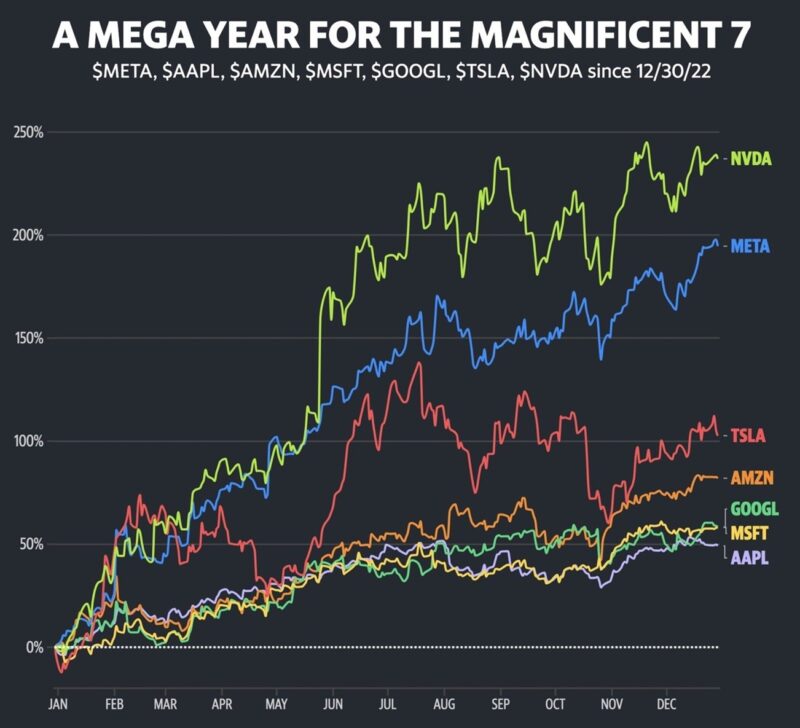

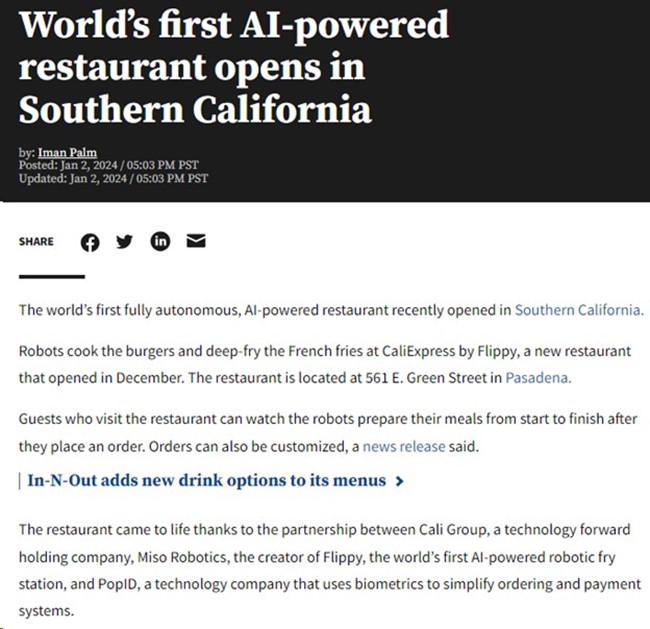

• The Big Story: Generative Artificial Intelligence (AI) propelled the stock market and provided tailwinds to the digital revolution, which impacts every aspect of the economy and indeed of modern life. Productivity and profitability were strengthened and ChatGPT became the fastest-growing app of all time. Examples of other important innovations this year: The regulatory approval of a new class of weight-loss drugs — such as Novo Nordisk’s Wegovy — will lower healthcare costs. Toyota’s progress on solid-state batteries may be a game-changer for the electric vehicle industry.

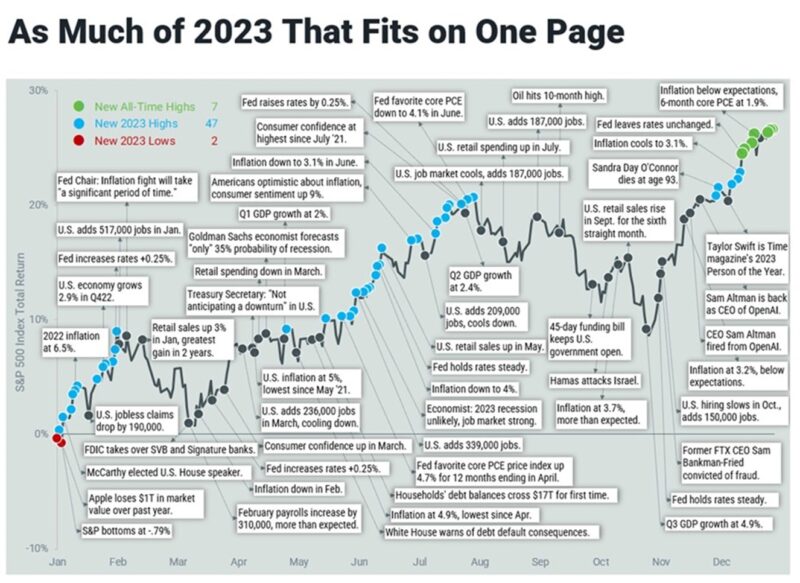

CHARTS THAT TELL THE STORY

A picture tells a thousand words, and a chart tells a thousand pictures.

1. INFLATION IN DECLINE

2. HOME MORTGAGE RATES – 30 YEAR FIXED

3. TREASURIES OVER THE PAST YEAR

4. CORPORATE EARNINGS ARE STRONG AND GROWING

5. CONSUMERS ARE FINANCIALLY HEALTHY AND OPTIMISTIC

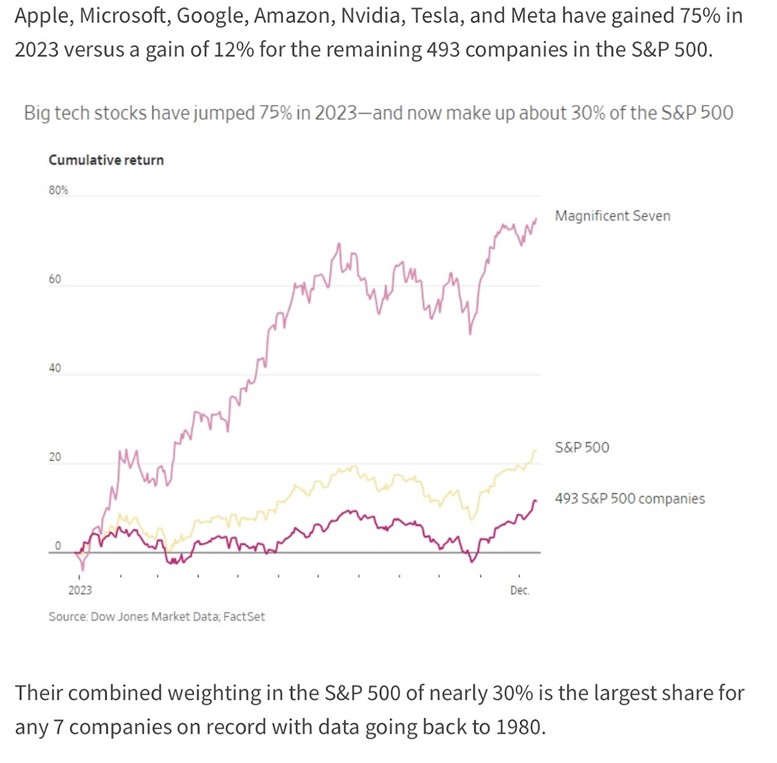

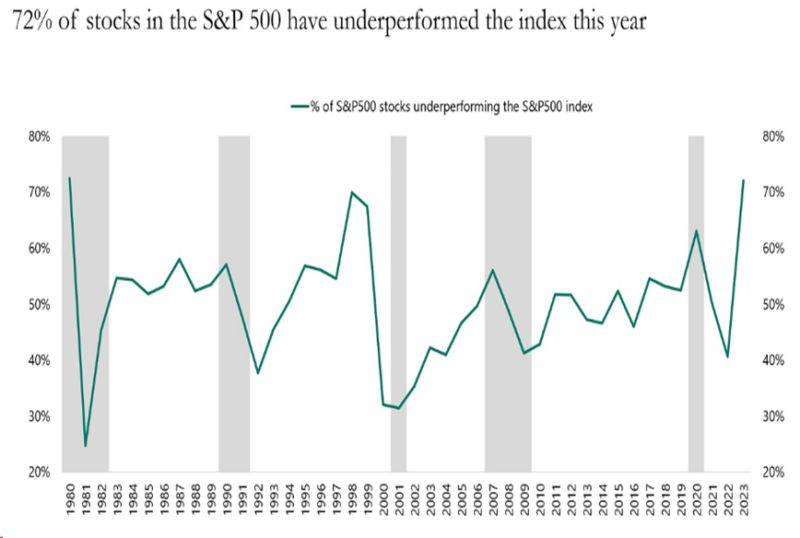

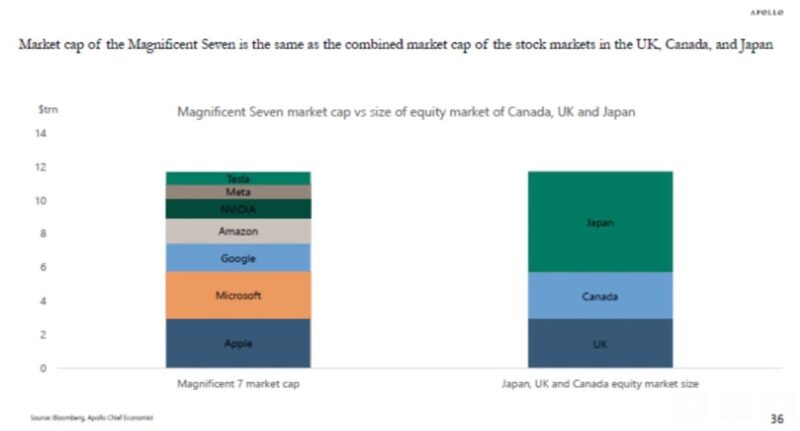

THE EQUITY MARKETS WERE LARGELY CARRIED BY THE OUTPERFORMANCE OF A FEW STOCKS

THE BIG STORY: ARTIFICIAL INTELLIGENCE

This video explains clearly what AI is, how it works and how it will impact almost every aspect of life as we know it. Then we feature just 2 examples of applications. To watch the full video CLICK HERE

To read the full story CLICK HERE

To Read the complete Bain & Co Report CLICK HERE

TOP 4 MISCONCEPTIONS ABOUT THE ECONOMY IN 2023

Leading economists predicted a recession because that is what experts such as Yellen, Romer and Summers had been teaching for decades..

2023 was a year in which many experts got a lot of things wrong about the economy. From mistaken forecasts about an impending recession to errors about falling prices and why they had risen in the first place, 2023 was a year marked by economic confusion. Even the Federal Reserve got disoriented, predicting an economic downturn at the beginning of the year and then yanking that prediction over the summer.

US Federal Reserve Chair Jerome Powell expressed fear in March that bringing down the rate of inflation would cost millions of American jobs.

As Treasury Secretary Janet Yellen said recently: “So many economists were saying there’s no way for inflation to get back to normal without it entailing a period of high unemployment, [or] a recession.” Many of those economists may have been relying on the work of … Janet Yellen. She is also co-author (with many distinguished colleagues) of a well-known paper arguing that there is an output/inflation trade-off even at high rates of inflation.

Here’s what they got wrong:

1. Rising interest rates are sure to cause a recession and a bear market for equities. Wrong.

There was virtual certainty among economists at the end of last year that 2023 would see a recession. The debate was whether that recession would be short-lived and relatively superficial or long and serious, entailing a major spike in unemployment. “The recession we have now been anticipating for nine months draws nearer,” Deutsche Bank analysts Peter Hooper and David Folkerts-Landau wrote in November of last year. “Our expectation for a recession in the US by mid-2023 has strengthened.”

That incorrect forecasting was based on the assumption that rising interest rates would directly slow the economy, tanking markets and causing workers to be fired.

2. Unemployment needs to go up for inflation to go down. Wrong.

Economists have long correlated inflation and unemployment in part because employment costs are the major portion of overhead paid by companies. In the third quarter of this year, employee compensation was about 58 percent of real prices, input costs were about 26 percent, and profits were about 16 percent. 2023 unbuckled the correlation between unemployment and inflation.

Headline inflation as measured in the consumer price index (CPI) fell from a 6.3% annual increase in January off a high last year of nearly 9% to just 3.1% in November. The sharp drop in inflation came as the jobless rate barely moved. Since inflation hit its 9% peak last June, unemployment has stayed between 3.4% and 3.9% — a far cry from the ranges of 6, 7 and even 10 percent predicted by economists last summer.

3. Wages aren’t rising for the lowest-paid workers. Wrong.

Amid so much concern over the magnitude and trajectory of inflation, average hourly earnings for all US workers have actually kept pace with rising prices since the pandemic started in March 2020. In fact, earnings have risen 19.4 % since February 2020, slightly outpacing the increase in the CPI of 18.8% over the same period. Lower-wage workers have seen a greater share of these gains, contributing to a shrinking of income inequality in the US.

For production and nonsupervisory workers, who account for the majority of the U.S. workforce, their wages have increased 21.9% since just before the pandemic, more than 3% points higher than the increase in the CPI. Hospitality and leisure industry staff, who are some of the lowest paid people in the economy, have seen their wages rise 27% over the same period.

4. Inflation had a single, clear-cut origin. Wrong.

Democrats and liberal economists have argued that inflation during the past year was caused primarily by supply-side disruptions while Republicans and conservative economists have blamed inflation on higher demand, boosted by trillions of dollars in pandemic stimulus. Other economists have said the blame should fall mostly with corporations who took the opportunity of consumers’ being flush with cash to raise their prices and boost their profit margins.

The Ukraine war’s effect on energy prices and further variants of the coronavirus that extended the pandemic in 2021 were also fingered as culprits. In fact, all of these factors contributed to varying degrees to the inflation that took off internationally starting in 2021 and lasted into this year. Holding up any single cause as the lone perpetrator ignores the dynamics between governments and the private sector that underlie the economy and the international price system.

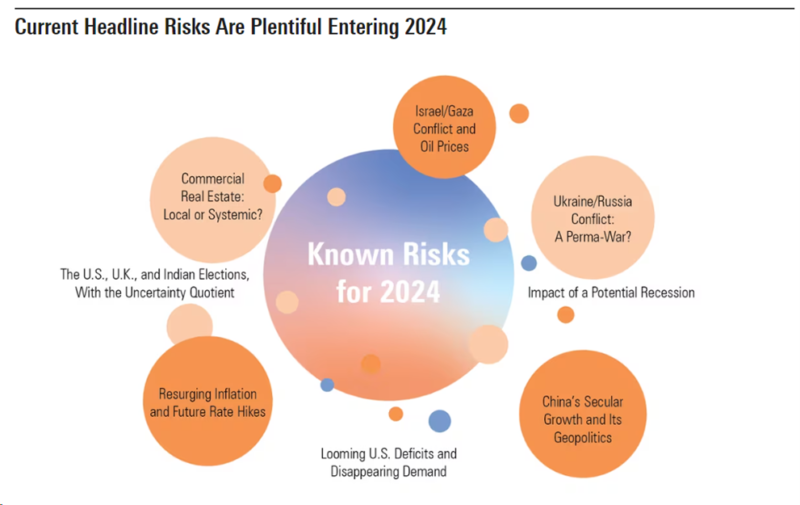

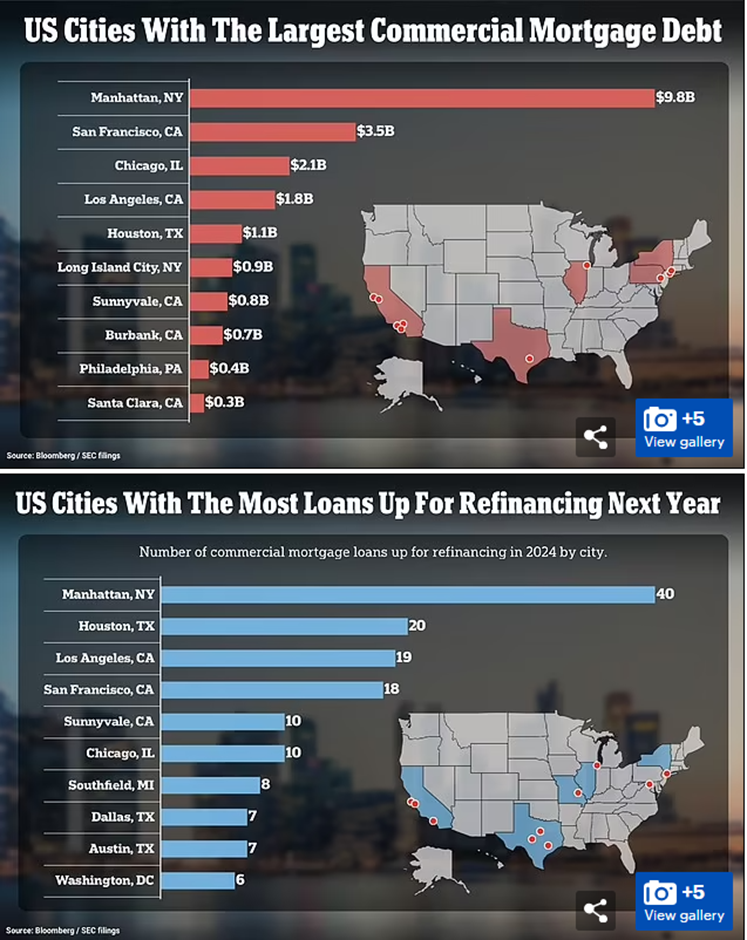

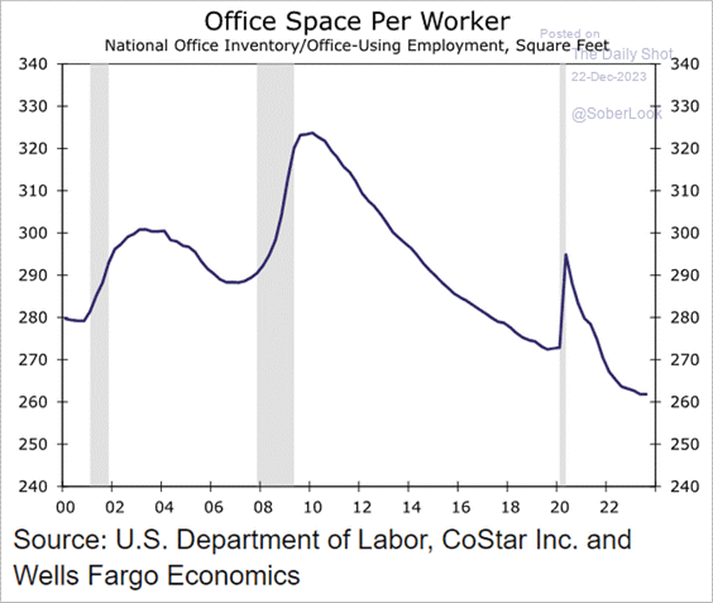

RISKS ON THE HORIZON

Clearly it is premature to declare that the Fed has pulled off a soft landing. Some are predicting a downturn next year, cautioning that it takes time for rate increases to ripple through the economy. In the past 11 Fed rate-hiking cycles, recessions have typically started about two years after the central bank begins raising interest rates.

The few big stocks that powered the market higher last year could run out of steam. Looming elections in the U.S., and wars in Europe and the Middle East, might make the world less investor friendly. The major risk remains disappointment over interest rates. Fed officials released projections of at least three rate cuts in 2024 after their most recent policy meeting but their indications have been unreliable.

ONE OF THE HEADWINDS THAT THE ECONOMY WILL BE FACING:

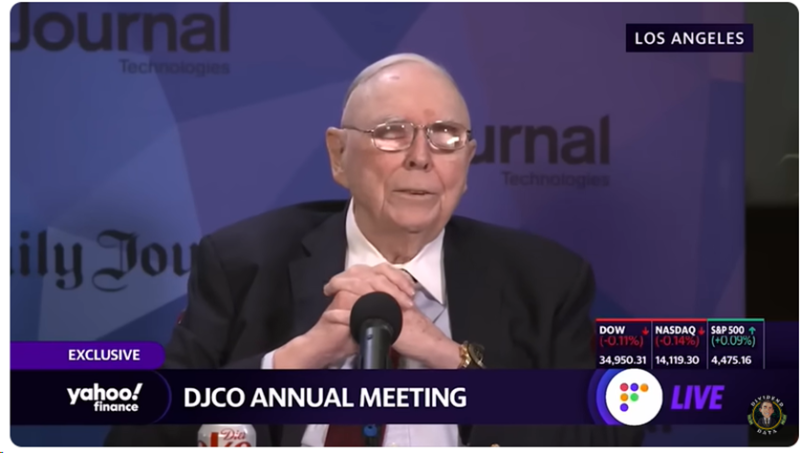

SSENTIAL VIEWING: LASTING LESSONS FROM Charlie MUNGER | HIGHLIGHTS 1924-2023

To watch this important video CLICK HERE

QUOTES HONORING THE LIFE AND LEGACY OF CHARLIE MUNGER, OUR HERO AND ON WHOSE SHOULDERS WE HAVE SAT FOR 20 YEARS

These quotes capture the essence of Charlie Munger’s wisdom and provide valuable insights into his mindset and approach to life and investing.

In memoriam of the late Charlie Munger, who would have turned 100 this month, a luminary in the realms of investing and wisdom, we pay homage to the enduring legacy he left behind. Beyond financial acumen, Munger’s quotes are timeless life lessons.

1. “There’s no way that you can live an adequate life without making many mistakes.”

2. “Anytime anybody offers you anything with a big commission and a 200-page prospectus, don’t buy it. Occasionally, you’ll be wrong if you adopt ‘Munger’s Rule.’ However, over a lifetime, you’ll be a long way ahead, and you will miss a lot of unhappy experiences.”

3. “Forgetting your mistakes is a terrible error if you are trying to improve your cognition.”

4. “Is there such thing as a cheerful pessimist? That’s what I am.”

5. “The best armor of old age is a well-spent life preceding it.”

6. “It never ceases to amaze me to see how much territory can be grasped if one merely master’s and consistently uses all the obvious and easily learned principles.”

7. “Choose clients as you would friends.”

8. “Acknowledging what you don’t know is the dawning of wisdom.”

9. “Our job is to find a few intelligent things to do, not to keep up with every damn thing in the world.”

10. “If you don’t allow for self-serving bias in the conduct of others, you are, again, a fool.”

11. “For some odd reason, I had an early and extreme multidisciplinary cast of minds. I couldn’t stand reaching for a small idea in my discipline when there was a big idea right over the fence in somebody else’s discipline. So, I just grabbed in all directions for the big ideas that would work.”

12. “The big money is not in the buying and selling, but in the waiting.”

13. “Spend each day trying to be a little wiser than you were when you woke up. Day by day, and at the end of the day, if you live long enough … you will get out of life what you deserve.”

14. “Everybody engaged in complex work needs colleagues. Just the discipline of having to put your thoughts in order with somebody else is a very useful thing.”

15. “I always knew from when I was a little boy that the important opportunities that were going to come to me were few and that the trick was to prepare myself for seizing the few that came. This is not the attitude that they have at a big investment council. They think that if they study a million things, they can know a million things.”

16. “I never allow myself to have an opinion on anything that I don’t know the other side’s argument better than they do.”

17. “A foreign correspondent, after talking to me for a while, once said: ‘You don’t seem smart enough to be so good at what you’re doing. Do you have an explanation?'”

18. “If it’s wisdom you’re after, you’re going to spend a lot of time on your ass reading.”

19. “Bull markets go to people’s heads. If you’re a duck on a pond, and it’s rising due to a downpour, you start going up in the world. But you think it’s you, not the pond.”

20. “Capitalism is a pretty brutal place.”

21. “If you have competence, you know the edge. It wouldn’t be competence if you didn’t know where the boundaries lie. Asking whether you’ve passed the boundary is a question that almost answers itself.”

22. “I regard it as very unfair. But capitalism without failure is like religion without hell.”

23. “A rough rule in life is that an organization foolish in one way in dealing with a complex system is all too likely to be foolish in another.”

24. “Assume life will be really tough, and then ask if you can handle it. If the answer is yes, you’ve won.”

25. “We’re emphasizing the knowable by predicting how certain people and companies will swim against the current. We’re not predicting the fluctuation in the current.”

26. “You have to learn to be a follower before you become a leader.”

27. “Opportunity comes to the prepared mind.”

28. “If you always tell people why, they’ll understand it better, they’ll consider it more important, and they’ll be more likely to comply.”

29. “I try to get rid of people who always confidently answer questions about which they don’t have any real knowledge.”

30. “Mankind invented a system to cope with the fact that we are so intrinsically lousy at manipulating numbers. It’s called the graph.”

31. “Being rational is a moral imperative. You should never be stupider than you need to be.”

32. “It takes character to sit there with all that cash and do nothing. I didn’t get to where I am by going after mediocre opportunities.”

33. “Whenever you think something or some person is ruining your life, it’s you. A victimization mentality is so debilitating.”

34. “In my whole life, I have known no wise people … who didn’t read all the time. … You’d be amazed at how much Warren reads, at how much I read. My children laugh at me. They think I’m a book with a couple of legs sticking out.”

35. “Knowing what you don’t know is more useful than being brilliant.”

36. “Recognize reality even when you don’t like it. Especially when you don’t like it.”

37. “We have to have a special insight, or we’ll put it in the ‘too tough’ basket. All of you have to look for a special area of competency and focus on that.”

38. “Those of us who have been very fortunate must give back. Whether one gives a lot as one goes along as I do, or a little and then a lot as Warren [plans to], is a matter of personal preference.”

39. “You don’t have to be brilliant, only a little bit wiser than the other guys, on average, for a long, long, time.”

40. ‘”Remember that reputation and integrity are your most valuable assets and can be lost in a heartbeat.”

MR. MARKET: EXERCISE CAUTION AMIDST HIS FLUCTUATING MOODS

Munger frequently employs the metaphor of “Mr. Market”, portraying him as a manic-depressive entity consistently presenting opportunities to buy or sell a share in a business. In moments of euphoria, Mr. Market may propose prices well beyond the intrinsic value of the business. Conversely, during periods of gloom, he might practically give it away. The crucial approach is one of patience and discipline, choosing to buy only when Mr. Market offers a bargain and selling when his actions become irrational.

IMPORTANT: The bespoke allocation of assets in your portfolio, as detailed in the statements received from your custodian, reflects our mutually agreed-upon design to respond to your needs and goals for safety, growth, and income, respectively. Contact us immediately if this portfolio design does not comport with your current situation or if there have been any changes in your life that have a financial impact. As trained Personal Financial Planners, our team stands ready to provide guidance and counsel in all related matters.

Thank you for entrusting your nest egg to our stewardship and to those who referred friends and family members to us—we are deeply grateful. RVW is about providing a successful investment experience. That means more than just returns. It means offering peace of mind because investors know that a transparent process backed by decades of research is powering every decision.

Your valuable feedback is important. Please take a moment and give us a review on Google (click here).

Sincerely,

Your RVW Wealth Team:

Selwyn Gerber, Jonathan Gerber, Loren Gesas, Mary Ann Moe, Simon Liu, Lisa Blackledge, Jesse Picunko, Dylan Scott, Teresa Green, Simmons Allen, Morgan Vickers, Kelly Sueoka, Shuey Wyne, Drew Wallis, Joseph Woods, and Kelly Richardson

FOR IMPORTANT CURRENT COMPLIANCE AND DISCLOSURE INFORMATION GO TO http://www.rvwwealth.com/compliance

NOTE: The information provided above is not complete, may be erroneous, and omits important data. The charts are estimates and may contain inaccuracies or distortions.

Read and rely exclusively on actual offering documents and on statements received directly from your custodian. The information prepared by us is to highlight aspects of your investments but is incomplete. No decision should be made, or action taken based on it. Investments are not guaranteed and may lose value. Past performance is not indicative of likely future returns.